Maximizing Your Roth IRA: Tax-Savvy Strategies for Long-Term Growth

Roth IRAs offer a unique advantage: tax-free growth and withdrawals. This tax benefit makes Roth IRAs ideal for holding high-growth investments. But how do you strategically maximize the potential of your Roth IRA? Let’s explore.

What Makes Roth IRAs Ideal for Growth Investments?

Imagine growing your wealth without worrying about future tax bills—this is the power of a Roth IRA. The combination of tax-free growth and withdrawals provides an unparalleled opportunity to optimize your portfolio, especially when holding investments with higher growth potential. By focusing on these benefits, you can set yourself up for long-term financial success.

Strategic Investment Allocation Across Account Types

At Evensky & Katz/Foldes, we strategically allocate investments between tax-deferred and taxable accounts based on three key factors. This ensures our clients achieve the most tax-efficient outcomes while optimizing returns over time.

The Key Factors to Consider for Tax-Efficient Investing

1. Tax Cost Ratio: A Measure of Tax Efficiency

This metric shows how much a fund’s annualized return is reduced by the taxes investors pay on distributions. The higher the percentage, the less tax-efficient the investment is.

2. Potential Capital Gain Exposure: Predicting Future Taxes

This estimate measures the percentage of a fund’s assets that represent gains. It indicates how much the fund’s assets have appreciated and can signal potential future capital gain distributions.

3. Expected Returns: Leveraging Tax-Deferred Growth

This represents the anticipated return based on historical rates. Investments with higher expected returns may benefit more from the tax-deferred growth offered by accounts like Roth IRAs.

Generally, investments with higher tax cost ratios, higher potential capital gain exposure, and higher expected returns are best suited for tax-deferred accounts like Roth IRAs.

The Withdrawal Dilemma and why prioritizing is important:

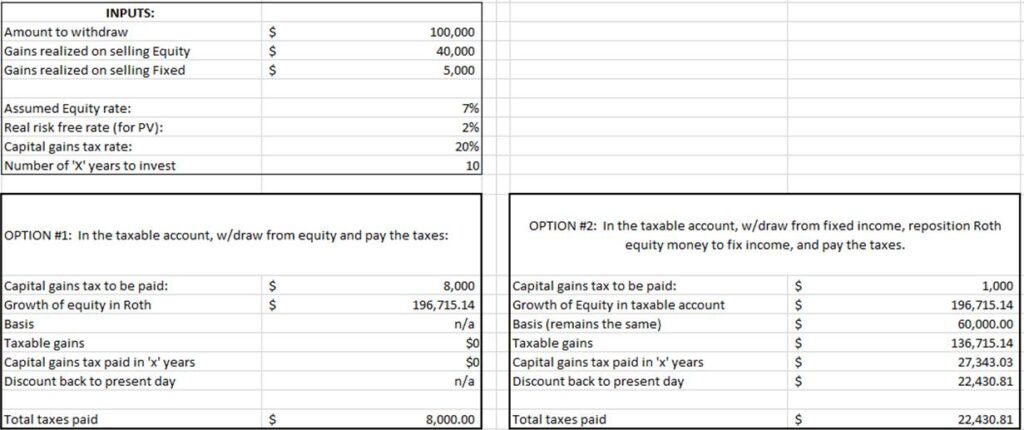

Consider a scenario where you need to withdraw $100,000 from a portfolio with a 40% Fixed Income/60% Equity allocation. To maintain this balance, the withdrawal should come from the equity portion. You have two options:

Withdraw $100,000 from a taxable account, paying capital gains tax.

Reposition some Roth IRA funds from equity to fixed income, allowing for a $100,000 withdrawal from fixed investments, reducing capital gains tax.

In almost all cases, Option #1 is preferable. This approach minimizes the disruption to your tax-advantaged growth potential. Exceptions may arise if the investment time frame is very short or the equity growth rate is exceptionally low.

Why Long-Term Growth Belongs in Your Roth IRA

Keeping growth-oriented investments in your Roth IRA maximizes its tax-free growth potential. This strategy is particularly valuable for individuals with a long investment horizon, as the compounding effect can significantly amplify your portfolio’s value over time. By prioritizing growth assets in your Roth IRA, you create a tax-efficient foundation for future wealth.

At Evensky & Katz/Foldes, we understand that tax-efficient investing is a cornerstone of successful portfolio management. By carefully considering asset allocation and withdrawal strategies, we help our clients make the most of their Roth IRAs and other investment accounts.

Ready to take your retirement planning to the next level? Connect with us and start maximizing your financial future.

Categories

Recent Insights

-

Evensky & Katz / Foldes Wealth Management: Interview With Principal & Chief Revenue Officer David Evensky About The Advisory Firm

Evensky & Katz / Foldes Wealth Management is a registered investment advisory firm that provides comprehensive wealth management, financial planning, and investment advisory services to individuals, families, and institutions. Pulse 2.0 interviewed Evensky & Katz / Foldes Wealth Management Principal and Chief Revenue Officer David Evensky to gain a deeper understanding of the company.

-

Budgeting and Financial Organization: Lessons from Life, Love, and Messy Homes

Recently, my wife sent me an opinion article from The New York Times titled “My Home is Messy, and I Don’t Feel Bad About It” by KC Davis. The author highlights many reasons why being messy can be a positive trait—from fostering creativity to accepting that the same DNA that “makes us shine can’t be…

-

Talk Your Chart | 2026 Predictions: A Year in Review and a Look at the Year Ahead | Ep. 75

Episode 75 of Talk Your Chart kicks off the new year with Marcos and Brett revisiting their 2025 predictions to see what held up, what missed, and why. From stocks and bonds to GDP growth and Bitcoin, they break down the charts that mattered most and share their outlook for the year ahead. Charts available…

-

Private Family Foundations: A Legacy of Giving and a Classroom for the Next Generation

For families who want to make a lasting impact, a Private Family Foundation (PFF) can be both a philanthropic vehicle and a platform for teaching values across generations. At its core, a private foundation is a tax-exempt nonprofit organization that you create and control—one that supports the causes you care deeply about, both during your…

-

The Looming ACA Premium Tax Credit Cliff: How Families Can Manage Rising Healthcare Costs

Picture this: You finally have a handle on your healthcare costs. The numbers make sense. The plan fits. But a sudden change in policy could flip everything upside down. It can feel like the ground shifting beneath your feet. For many families, the potential expiration of enhanced ACA Premium Tax Credits at the end of…