Topics

Topic:

Client Services

-

Understanding Form 5500: A Guide for Business Owners

When it comes to managing your company’s retirement plan, one of the most important responsibilities is filing Form 5500. This form is crucial for maintaining compliance and protecting both your business and your employees. Let’s break down what Form 5500 is, why it matters, and share some practical advice on what to do if you’ve…

-

Expert Insight on Financial Independence for Women

The Women’s Guide to Financial Independence

-

Average Retirement Account Balance of Americans

Retirement Savings by Age

-

Issues to Consider When Creating Your Estate Plan | 2024

Estate planning can often be overlooked, yet it’s crucial for ensuring your wishes are carried out and your assets are managed effectively. Many people are unsure where to start or what questions to ask. This checklist is designed to provide clarity and guide you through the essential elements of estate planning. Key Considerations Include: Use…

-

Talk Your Chart | Navigating Market Jitters: From Bond Buzz to Workforce Woes | Episode 59

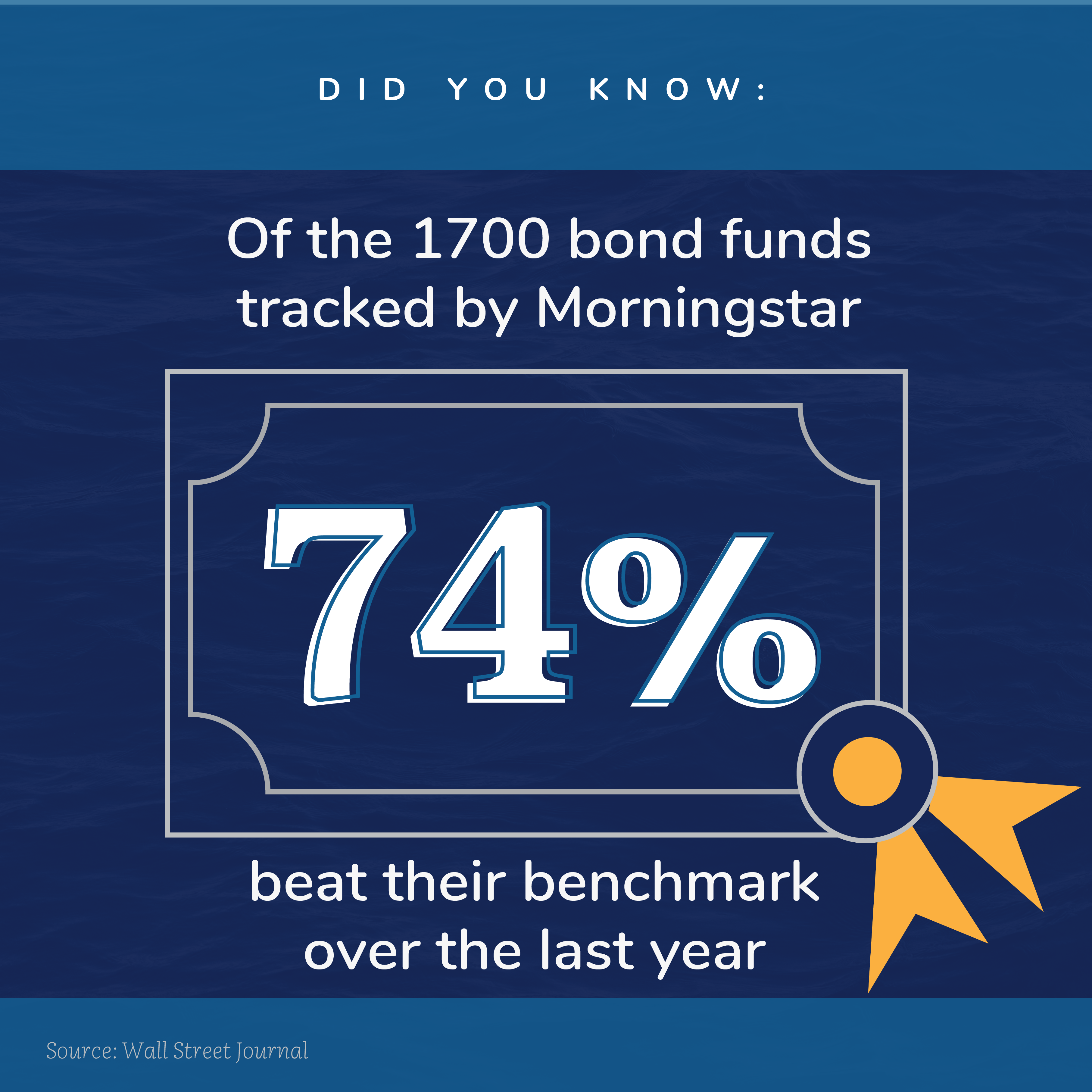

Episode 59 of Talk Your Chart takes you on a deep dive into the financial world’s current hot topics. Brett and Marcos discuss the market’s reaction to job numbers, the implications of the Sahm Rule, and the gradual changes in unemployment rates. Explore the outlook on growth stocks, bond funds outperforming benchmarks, and the international…