Topics

Topic:

Client Services

-

Talk Your Chart | Navigating Market Jitters: From Bond Buzz to Workforce Woes | Episode 59

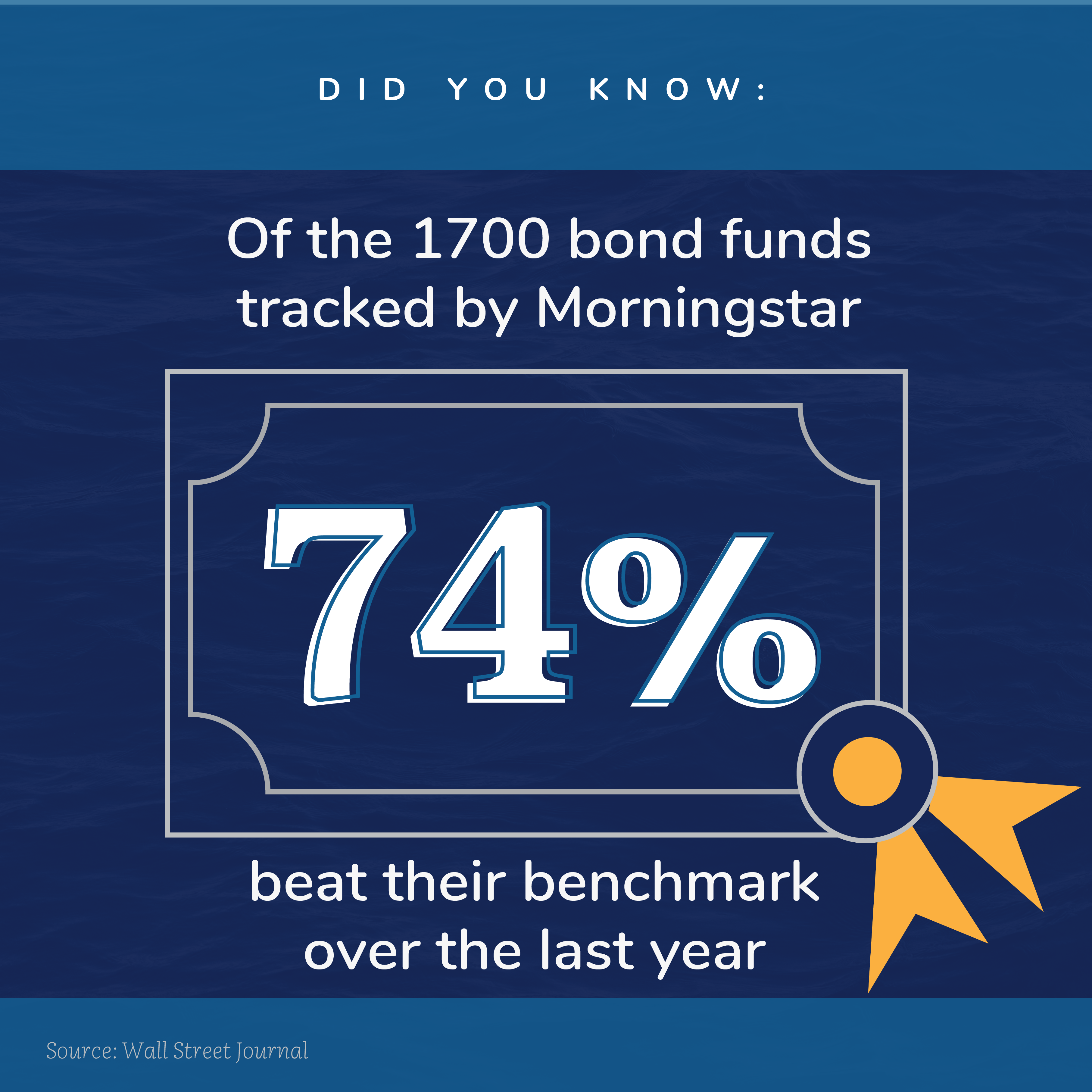

Episode 59 of Talk Your Chart takes you on a deep dive into the financial world’s current hot topics. Brett and Marcos discuss the market’s reaction to job numbers, the implications of the Sahm Rule, and the gradual changes in unemployment rates. Explore the outlook on growth stocks, bond funds outperforming benchmarks, and the international…

-

401(k) vs. Life Insurance: Which Is Better for Retirement?

Experts’ Advice About Choosing Between 401(k) and Life Insurance

-

How to Nail Your First Marketing Hire and Set Them Up for Success

Let’s be real: Hiring your first marketing professional can feel like you’re on a wild treasure hunt for a mythical creature. You might think you need a one-person powerhouse who can do it all—design your brand, write every piece of content, run entire marketing campaigns, manage PR, and probably juggle fire while doing it. But…

-

Market Update: Interpreting Recent Declines

U.S. equity markets pushed to new highs as recently as a few weeks ago, inspired by data that showed the U.S. economy grew at a 2.8% rate in the last quarter and anticipation that the Federal Reserve was about to begin taking their foot off the economic brakes by cutting interest rates in their September…

-

Regulation S-P Receives a Boost

The SEC’s recent amendments to Regulation S-P highlight the ongoing focus on data privacy and security. These changes directly impact how RIAs manage and protect client information. Here’s a breakdown of the key updates and what they mean for compliance efforts. Background on Regulation S-P Since 2000, Regulation S-P has required Registered Investment Advisers, Broker-Dealers,…