Topics

Topic:

Wealth Management and Financial Advisors

-

Lagniappe: Some Final Takeaways

The following is an excerpt from Chapter 23 of Hello Harold written by Harold Evensky. It has been adapted and edited for easier digital reading. I couldn’t resist using one of my favorite words—lagniappe. It means a little something extra given at no cost, somewhat like the thirteenth doughnut in a baker’s dozen. Because there…

-

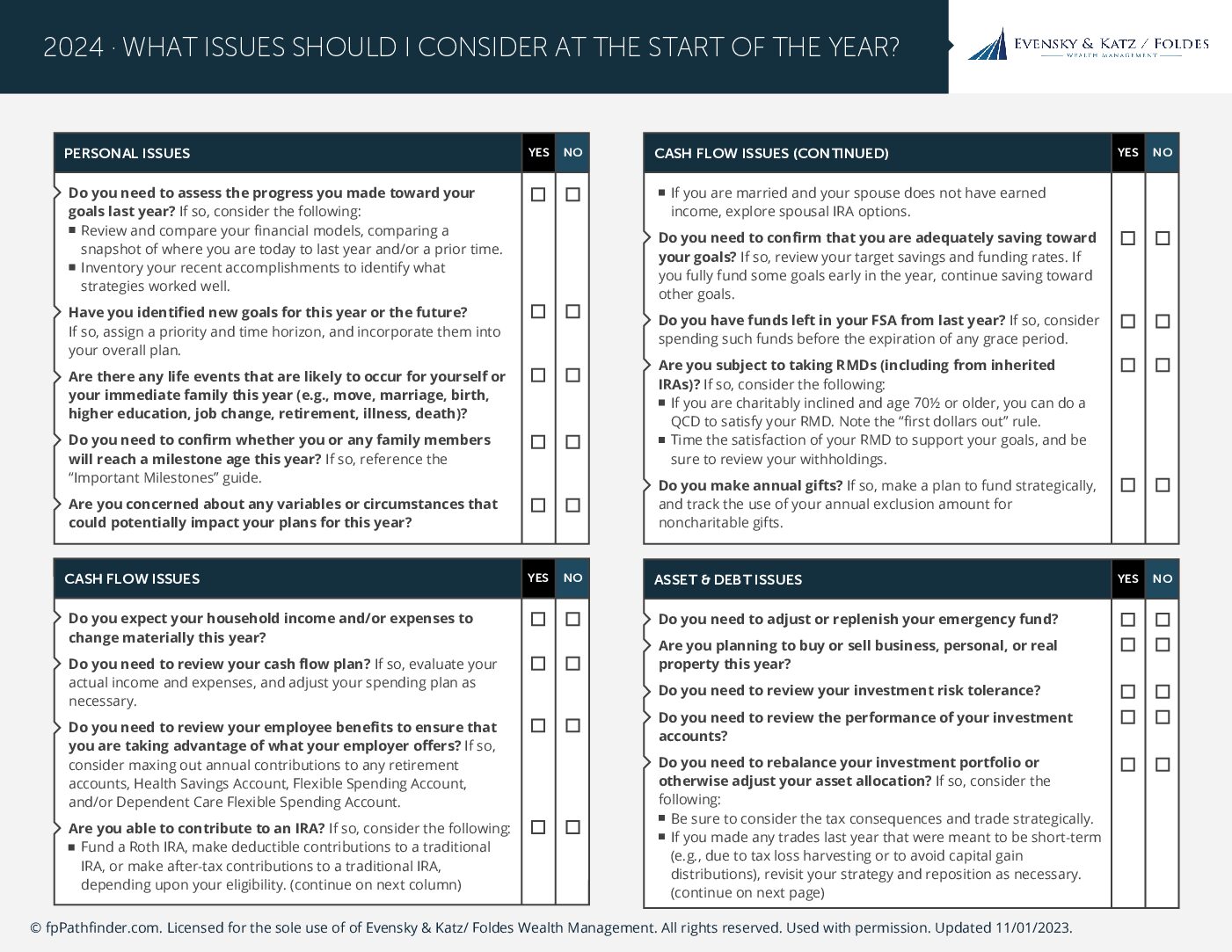

What Issues Should I Consider At The Start Of The Year? | 2024

The beginning of the year is an ideal time for a financial check-up. As you reflect on the past year and set resolutions for the future, this checklist will guide you through essential areas to review and improve. Key Areas Covered: Use this checklist to start the year with a clear financial plan and make…

-

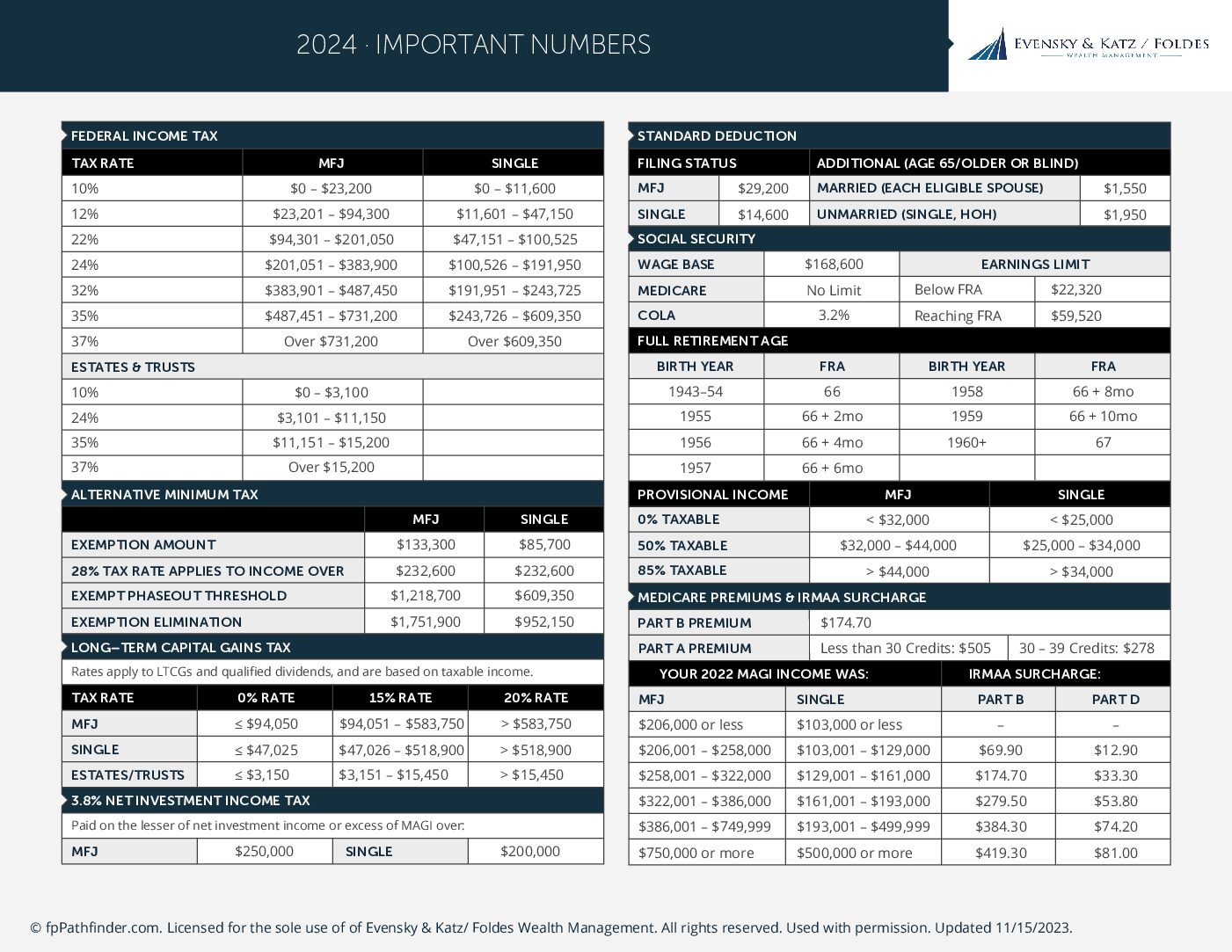

Important Dates 2024

This guide is designed to provide quick, accurate references for the most frequently needed financial numbers, ensuring you have the information you need at your fingertips. Key Features Include:

-

Talk Your Chart | Predictions Episode: 2023 Results and Outlooks for 2024 | Episode 49

The Talk Your Chart duo is back, unveiling their 2024 predictions in nine financial battlegrounds! From Dogs of the Dow to Recession 2023, U.S. vs. International equity, 10-year Treasury Rates, Bitcoin prices, Inflation, Asset Class of the Year, S&P 500 year-end forecast, to Unemployment – it’s prediction time. Who will emerge victorious this year? Whose…

-

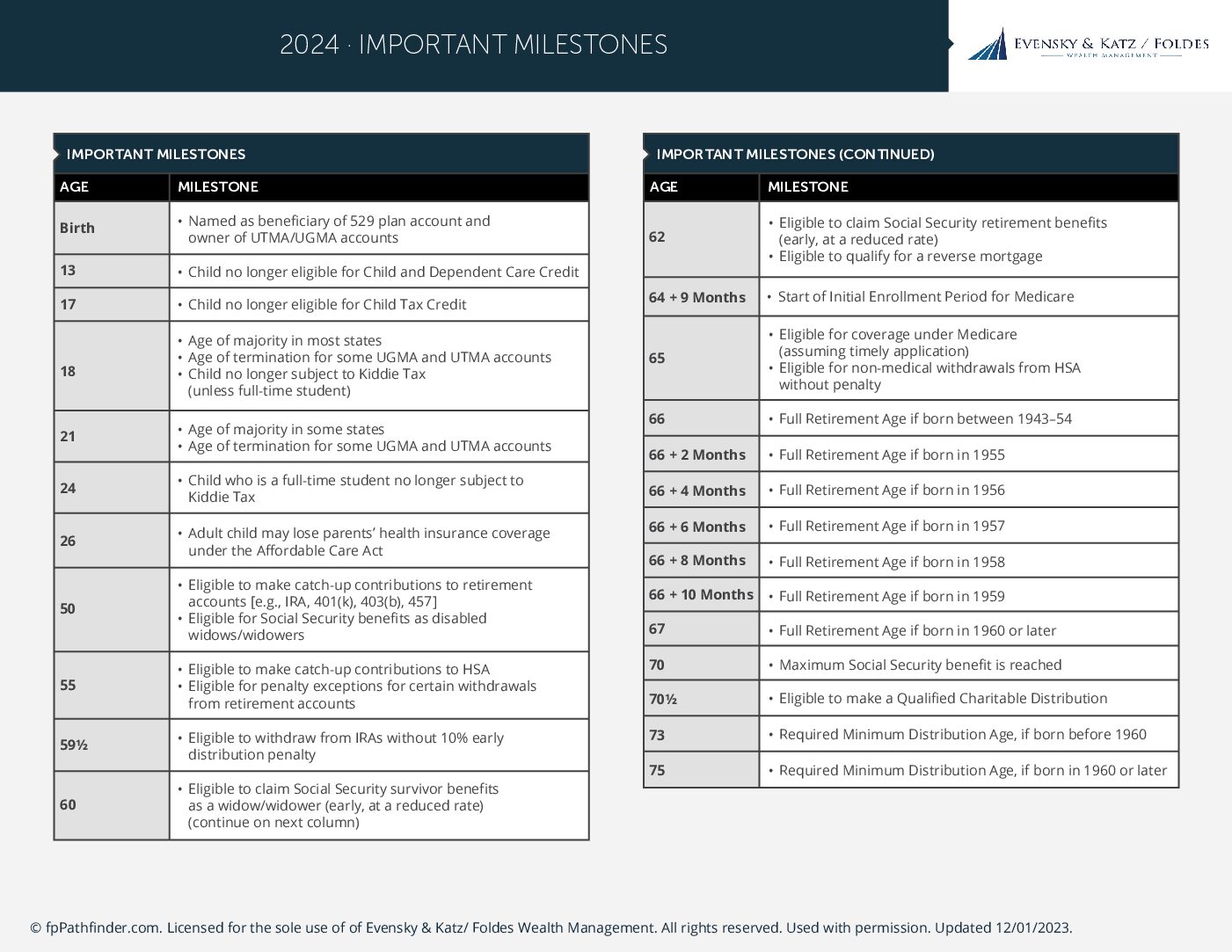

Important Milestones 2024

Our updated “Important Milestones” guide now incorporates the latest changes from The SECURE Act 2.0, effective for 2024. This essential resource provides a clear overview of key milestones based on age, residency, and personal circumstances. Key Features Include: Stay informed and make the most of these significant milestones with our easy-to-use guide.