Stuck in the Middle: Life as a Sandwich Generation Caregiver

Psst! Over here, down here in between the sliced bread, lettuce, tomato, cheese, and deli meat. Yes, that’s right, I am in the sandwich generation! This term was coined in the early ’80s to describe individuals sandwiched between raising their children and caring for aging parents. We juggle our careers, home responsibilities, and family caregiving duties on both ends.

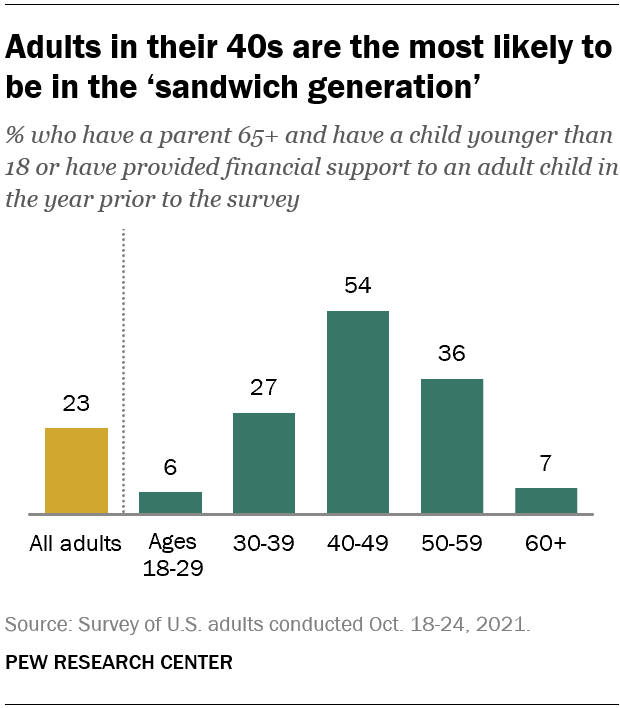

If this sounds familiar, you’re not alone. This group, known as the “sandwich generation,” makes up about 23% of American adults, according to a survey conducted in late 2021.

What Is the Sandwich Generation (And How Did We End Up Here)?

If you’re feeling this squeeze, you’re part of a group that now makes up about 23% of American adults, according to a recent survey. The survey found that the most common age range for sandwich generation members is adults in their forties, with over half (54%) having a parent aged 65 or older while still raising or financially supporting a minor or adult child. For those of us balancing it all, this can feel like a lot—but you’re not alone.

As people get older, the likelihood of being in this position shifts. About 36% of adults in their fifties and 27% of those in their thirties fall into the sandwich generation category. The percentage dips below 10% for adults younger than 30 or older than 60.

Double Duty: Raising Kids While Caring for Parents

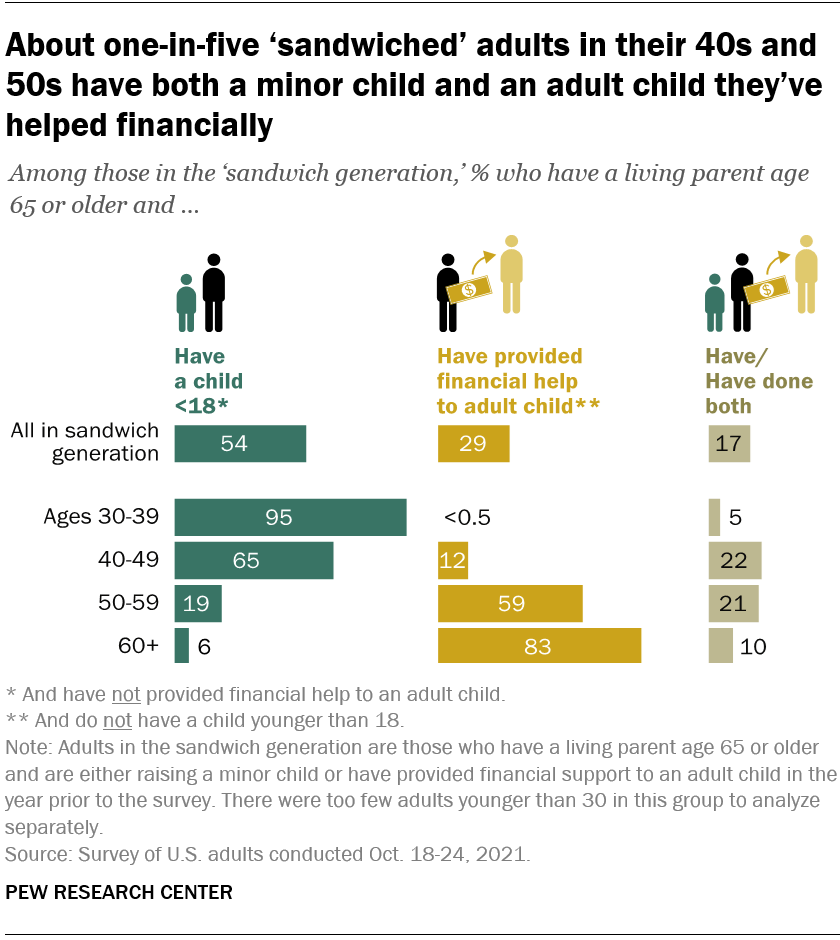

The caregiving mix also changes with age. For those of us in our thirties and forties, it’s all about caring for minor kids while helping our aging parents. But for folks in their fifties and beyond, it shifts to supporting adult children financially while still being there for elderly parents.

Several factors influence whether someone becomes part of this group. Education, income, and marital status are key. People with higher incomes, more education, and those who are married are more likely to find themselves juggling caregiving for both children and elderly parents. One in five of adults in their forties and fifties are supporting both a minor and an adult child at the same time. (No rest for the weary!)

Coping with Dual Caregiving Responsibilities

Being part of the sandwich generation brings unique stressors. Managing the emotional and financial responsibilities of caring for both children and parents can be overwhelming. So, how do these caregivers cope?

- Time Management: Prioritizing daily tasks and setting boundaries is essential. Many in the sandwich generation rely on structured schedules to balance work, family time, and self-care.

- Financial Planning: Dual caregiving can strain financial resources. Seeking professional financial advice can help individuals manage their current responsibilities while safeguarding their future, especially in terms of retirement planning.

- External Support: Hiring professional caregivers or seeking community services for elderly parents can help alleviate some of the burden. Additionally, many turn to technology—such as caregiving apps or virtual health monitoring tools—to streamline tasks and stay on top of both children’s and parents’ needs.

The Satisfaction Paradox: Finding Joy Despite the Juggle

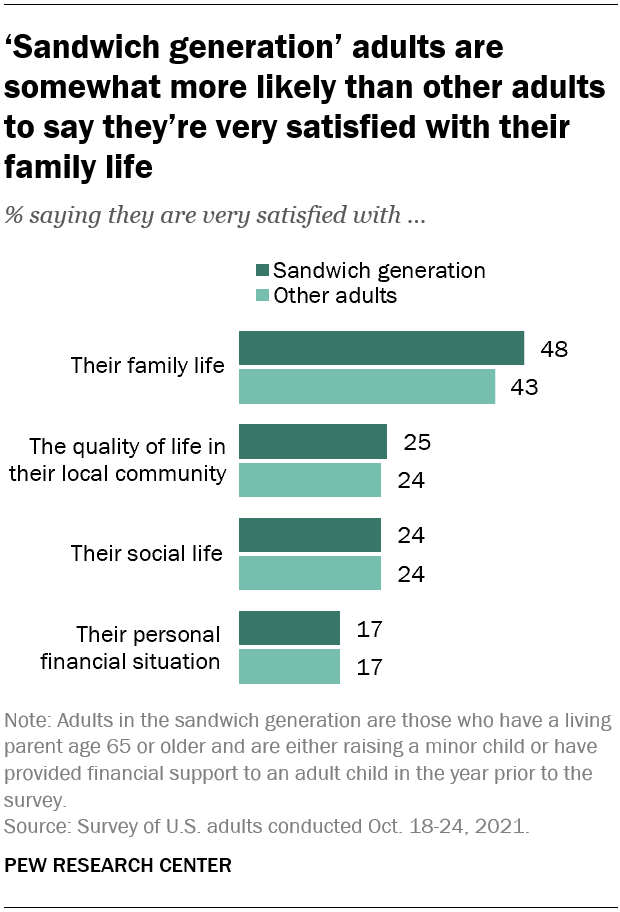

If you feel like you’re balancing too much, here’s an encouraging statistic: adults in the sandwich generation—especially those in their forties—report higher levels of satisfaction with their family life compared to other groups. Crazy, right? It seems that despite the stress, people find meaning and happiness in staying connected to both their children and parents.

However, in other areas—like social satisfaction and personal finances—the difference between sandwich generation members and other adults is less significant.

Multigenerational Living: A Growing Trend in Modern Households

With multigenerational households growing in popularity, about one in five adults—sandwiched or not—now lives with parents, children, or both. And though the rise of multigenerational living isn’t entirely new (we see similar percentages today compared to a 2014 survey), it remains an important part of American family life. As life expectancy increases and young adults face challenges in achieving financial independence, the sandwich generation phenomenon is likely to continue shaping family structures and caregiving responsibilities in the United States.

The sandwich generation will likely be a fact of life for many Americans in the years to come. While caregiving can be challenging, it’s clear that balancing family responsibilities, even at its most stressful, still brings its own rewards.

Feeling overwhelmed by the demands of caring for kids and aging parents?

You’re not alone! Let’s create a financial plan that fits your unique situation. Connect with an advisor and let’s find balance in your busy life!

Categories

Recent Insights

-

Protect Profits and People: The Top 3 Risk Management Strategies for Your Business

Running a business is about more than day-to-day operations — it’s about protecting the hard work you’ve invested and the people who make it possible. Business owners face the dual challenge of maintaining profitability while creating a workplace where employees feel valued and secure. Smart companies understand that risk management and employee retention are interconnected.…

-

Is FIRE Still Realistic?

The modern FIRE movement may be less about quitting work and retiring, and more about buying back your time.

-

This single mom saved $1 million in 15 years to retire at 49. How to use her strategies to catch up on retirement savings.

It’s not too late to fast-track your retirement savings, even if you’re 50 years old and have debt

-

Evensky & Katz / Foldes Wealth Management: Interview With Principal & Chief Revenue Officer David Evensky About The Advisory Firm

Evensky & Katz / Foldes Wealth Management is a registered investment advisory firm that provides comprehensive wealth management, financial planning, and investment advisory services to individuals, families, and institutions. Pulse 2.0 interviewed Evensky & Katz / Foldes Wealth Management Principal and Chief Revenue Officer David Evensky to gain a deeper understanding of the company.

-

Budgeting and Financial Organization: Lessons from Life, Love, and Messy Homes

Recently, my wife sent me an opinion article from The New York Times titled “My Home is Messy, and I Don’t Feel Bad About It” by KC Davis. The author highlights many reasons why being messy can be a positive trait—from fostering creativity to accepting that the same DNA that “makes us shine can’t be…