Topics

Topic:

Tax Planning

-

Estate Planning Essentials: Leveraging Strategic Tools for a Lasting Legacy

Creating a comprehensive financial plan isn’t just about maximizing returns or minimizing taxes—it’s about building a legacy that lasts for generations. At the core of any robust financial plan lies a strategic approach to estate planning, utilizing tools like Transfer on Death (TOD) designations, wills, trusts, and strategic account ownership structures. While we don’t draft…

-

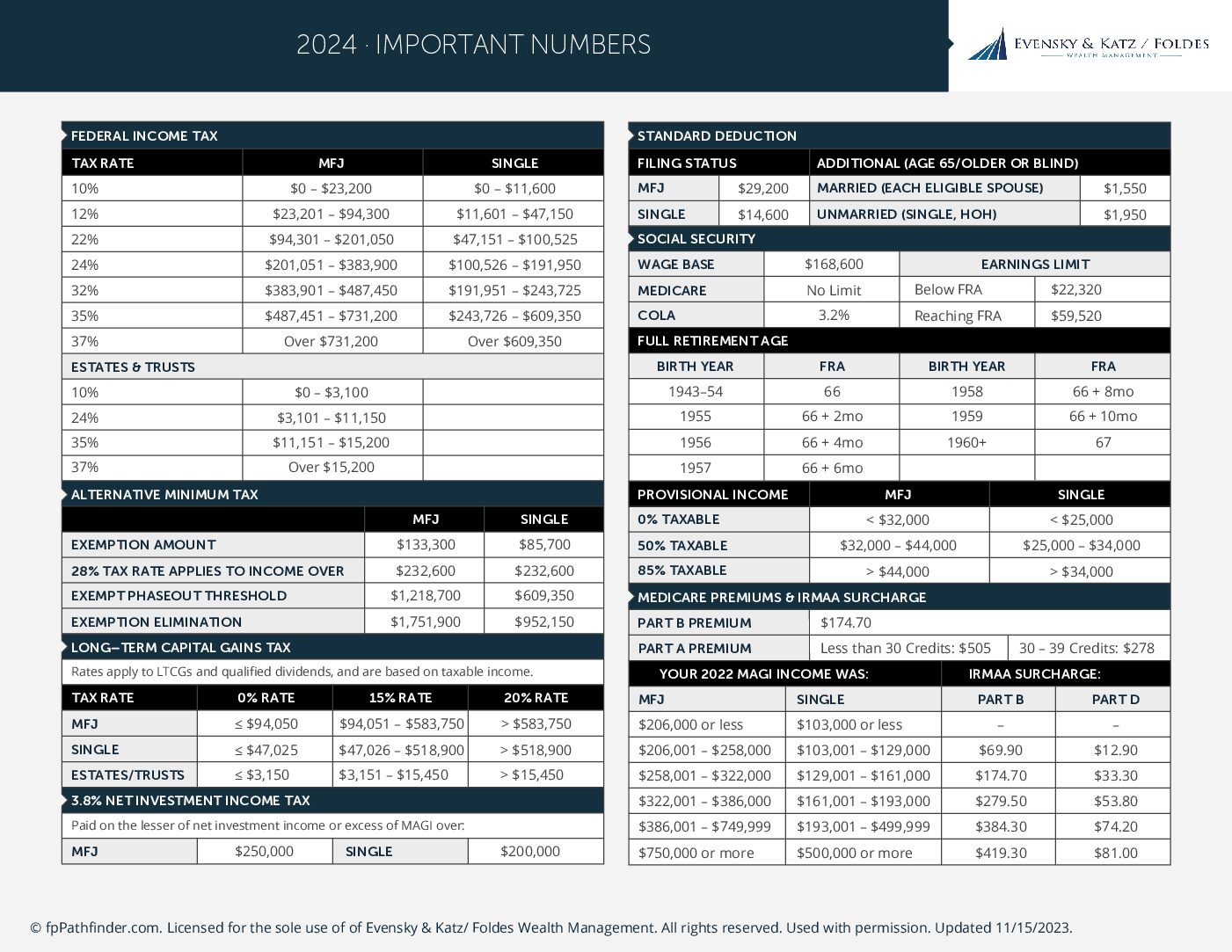

Important Dates 2024

This guide is designed to provide quick, accurate references for the most frequently needed financial numbers, ensuring you have the information you need at your fingertips. Key Features Include:

-

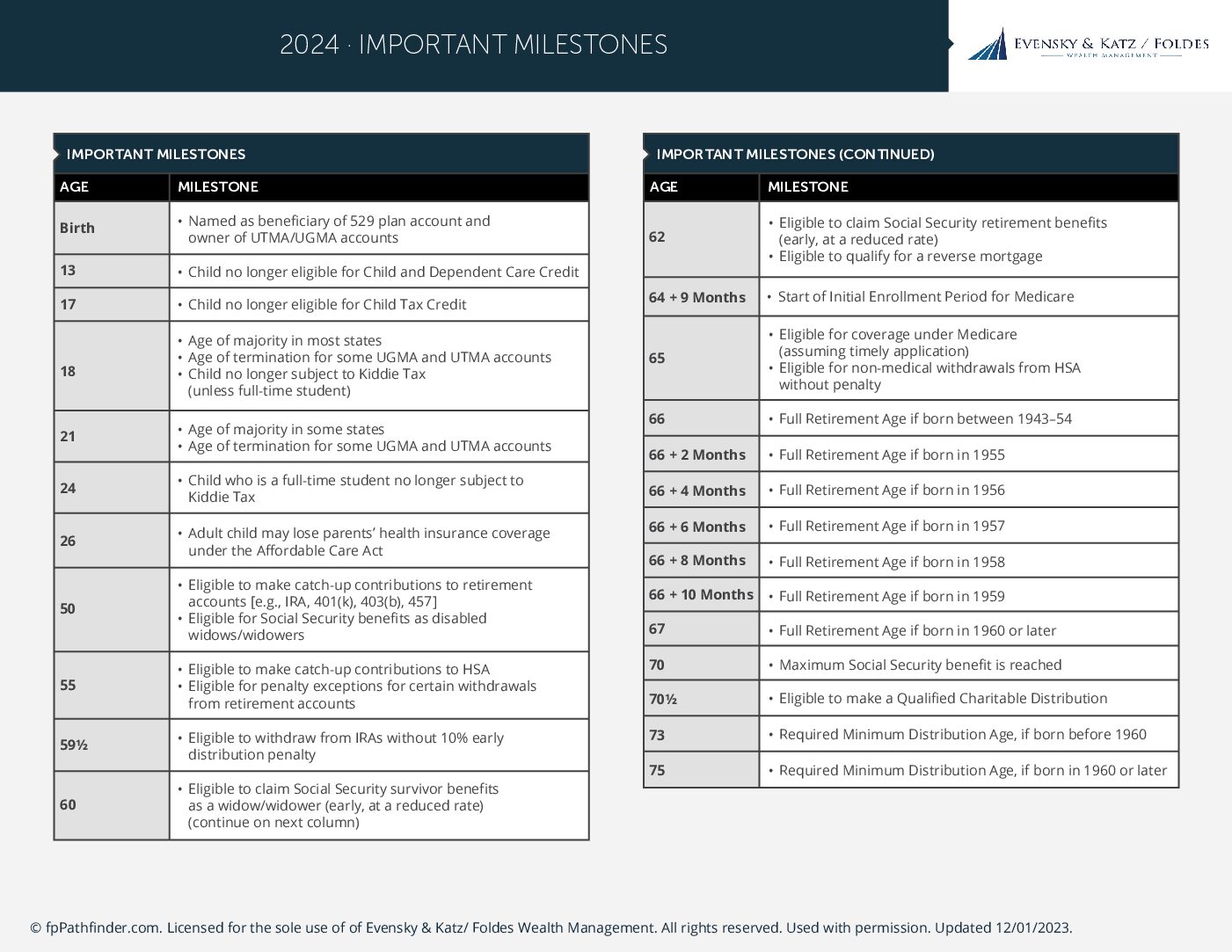

Important Milestones 2024

Our updated “Important Milestones” guide now incorporates the latest changes from The SECURE Act 2.0, effective for 2024. This essential resource provides a clear overview of key milestones based on age, residency, and personal circumstances. Key Features Include: Stay informed and make the most of these significant milestones with our easy-to-use guide.

-

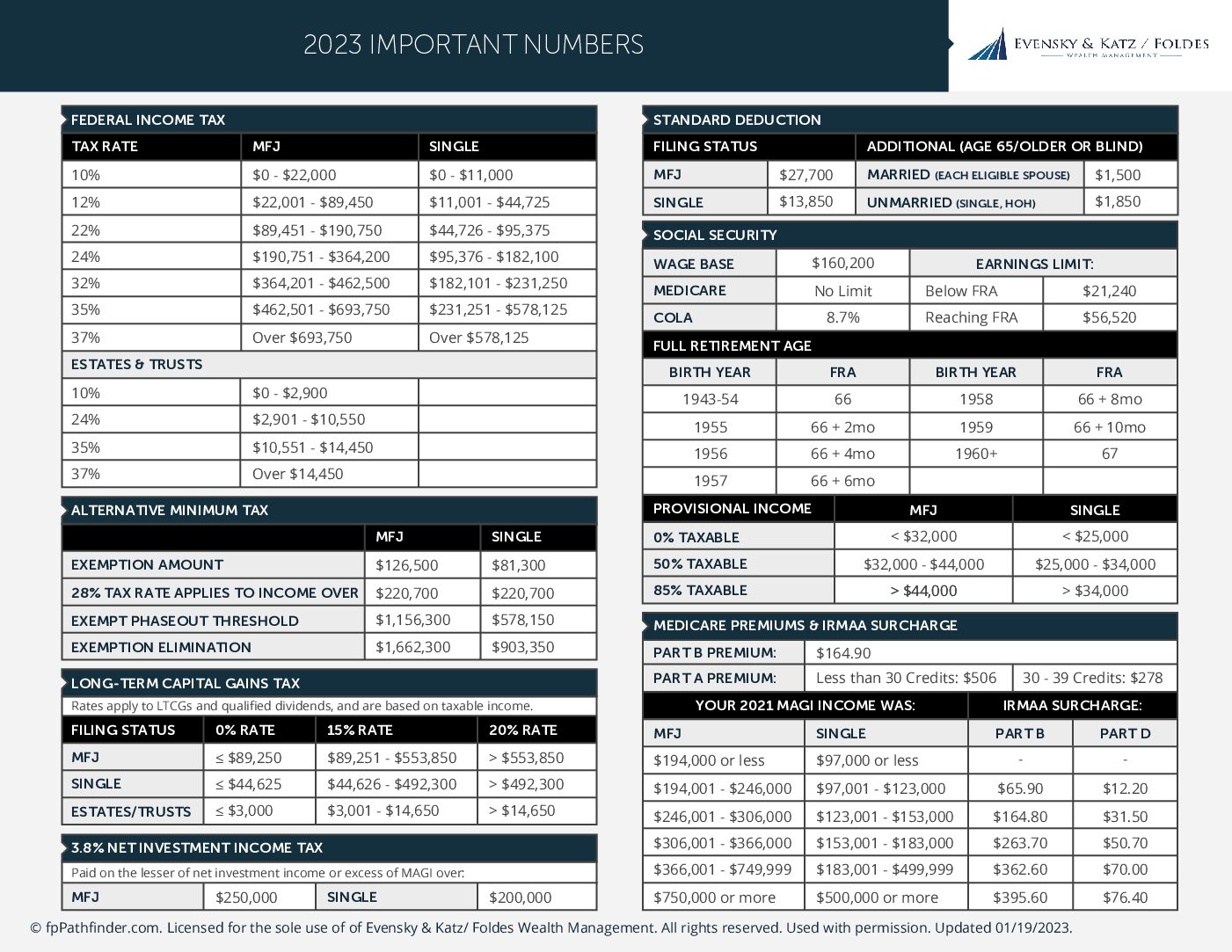

Important Dates 2023

This guide is designed to provide quick, accurate references for the most frequently needed financial numbers, ensuring you have the information you need at your fingertips. Key Features Include:

-

Beyond Billable Hours: Financial Considerations for Legal Professionals

As a partner or shareholder of a law firm, your financial structure might be less predictable or straightforward compared to traditional salaried employees. Between irregular cash flows from legal settlements, dividends, and distinct firm-related structures, there are complex tax and cash flow considerations that should be addressed in your financial plan. 1. Unpredictable Cash Flows…