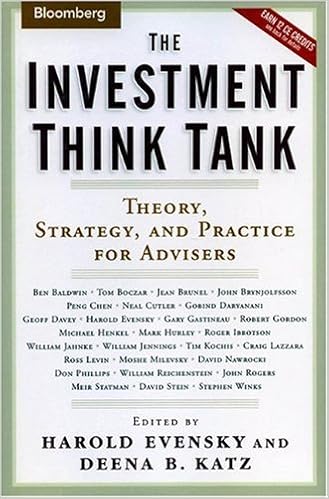

The Investment Think Tank: Theory, Strategy, and Practice For Advisers

Among the thought leaders contributing to the book are:

– Ross Levin, nationally known adviser and author of The Wealth Management Index, on monitoring success in helping clients reach their goals

– William Reichenstein, professor of finance, insurance, and real estate at Baylor University, on asset allocation

– Don Phillips, managing director of Morningstar, Inc., on constructing a portfolio of mutual funds

– Roger Ibbotson, founder and chairman of Ibbotson Associates and finance professor at Yale School of Management, on controlling risk in a retirement portfolio–and many more.

The biggest names, the biggest ideas in investment management, together in one book

Categories

Recent Insights

-

Talk Your Chart | 2026 Predictions: A Year in Review and a Look at the Year Ahead | Ep. 75

Episode 75 of Talk Your Chart kicks off the new year with Marcos and Brett revisiting their 2025 predictions to see what held up, what missed, and why. From stocks and bonds to GDP growth and Bitcoin, they break down the charts that mattered most and share their outlook for the year ahead. Charts available…

-

Private Family Foundations: A Legacy of Giving and a Classroom for the Next Generation

For families who want to make a lasting impact, a Private Family Foundation (PFF) can be both a philanthropic vehicle and a platform for teaching values across generations. At its core, a private foundation is a tax-exempt nonprofit organization that you create and control—one that supports the causes you care deeply about, both during your…

-

The Looming ACA Premium Tax Credit Cliff: How Families Can Manage Rising Healthcare Costs

Picture this: You finally have a handle on your healthcare costs. The numbers make sense. The plan fits. But a sudden change in policy could flip everything upside down. It can feel like the ground shifting beneath your feet. For many families, the potential expiration of enhanced ACA Premium Tax Credits at the end of…

-

Charitable Planning During a Liquidity Event: What to Consider Before You Sell

Liquidity events—selling a business, real estate, or a concentrated stock position—are rare moments that often define a business owner’s financial and philanthropic legacy. Before you sign the papers, thoughtful charitable planning can transform a tax liability into a purposeful legacy. The central rule is simple: start before the deal closes. Why timing matters When a…

-

When Love Ends, Who Keeps the Picasso? Dividing Art and Collectibles in Divorce

Divorce is never only about dividing assets. For many couples, the most difficult conversations don’t revolve around bank accounts or real estate—they center on the art, antiques, wine, or collectibles that hold both financial and emotional weight. Over the years, I’ve seen how these items often represent more than monetary value. They are memories, passions,…