Stuck in the Middle: Life as a Sandwich Generation Caregiver

Psst! Over here, down here in between the sliced bread, lettuce, tomato, cheese, and deli meat. Yes, that’s right, I am in the sandwich generation! This term was coined in the early ’80s to describe individuals sandwiched between raising their children and caring for aging parents. We juggle our careers, home responsibilities, and family caregiving duties on both ends.

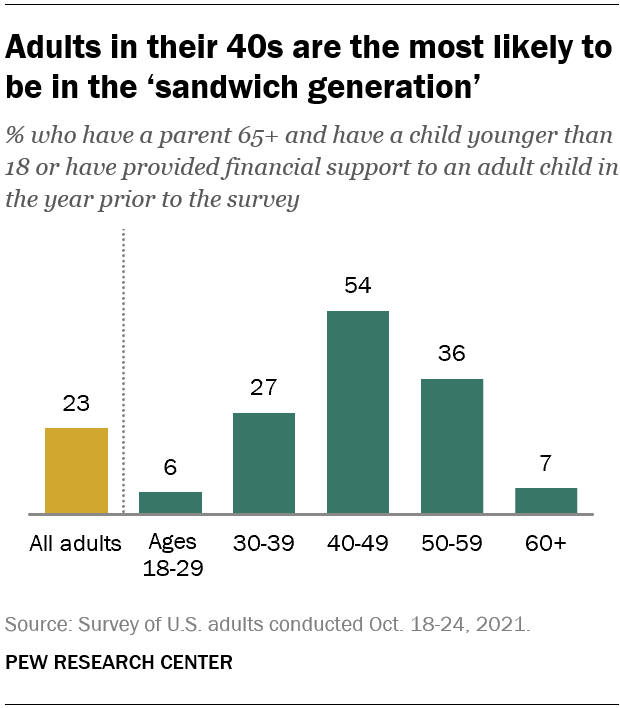

If this sounds familiar, you’re not alone. This group, known as the “sandwich generation,” makes up about 23% of American adults, according to a survey conducted in late 2021.

What Is the Sandwich Generation (And How Did We End Up Here)?

If you’re feeling this squeeze, you’re part of a group that now makes up about 23% of American adults, according to a recent survey. The survey found that the most common age range for sandwich generation members is adults in their forties, with over half (54%) having a parent aged 65 or older while still raising or financially supporting a minor or adult child. For those of us balancing it all, this can feel like a lot—but you’re not alone.

As people get older, the likelihood of being in this position shifts. About 36% of adults in their fifties and 27% of those in their thirties fall into the sandwich generation category. The percentage dips below 10% for adults younger than 30 or older than 60.

Double Duty: Raising Kids While Caring for Parents

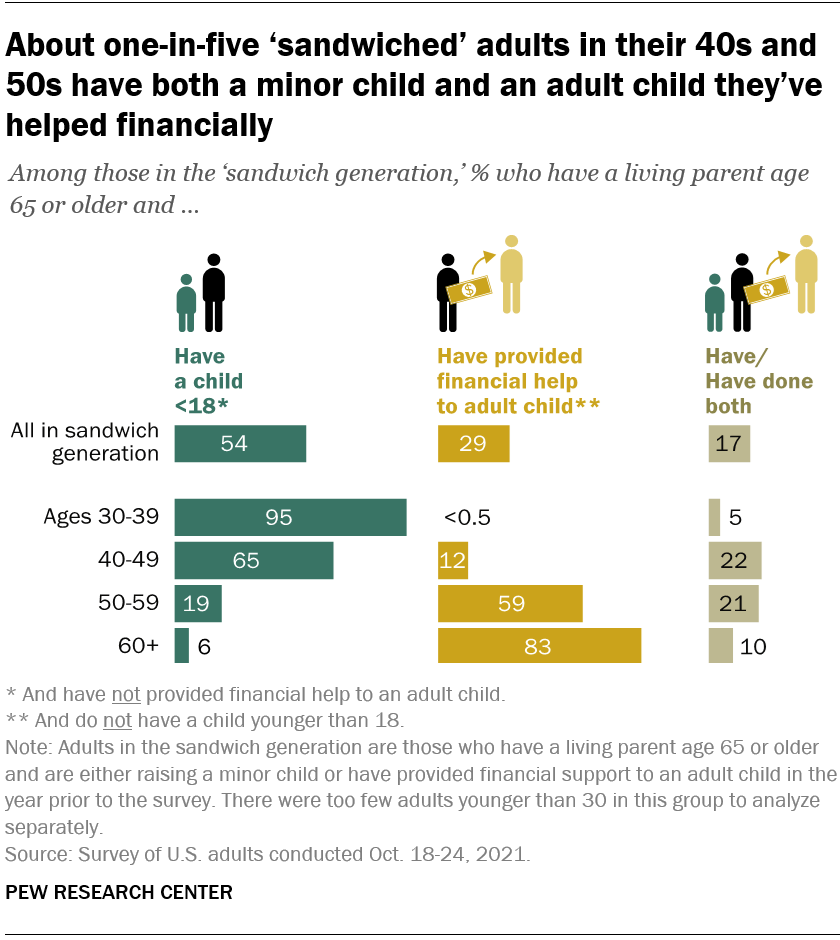

The caregiving mix also changes with age. For those of us in our thirties and forties, it’s all about caring for minor kids while helping our aging parents. But for folks in their fifties and beyond, it shifts to supporting adult children financially while still being there for elderly parents.

Several factors influence whether someone becomes part of this group. Education, income, and marital status are key. People with higher incomes, more education, and those who are married are more likely to find themselves juggling caregiving for both children and elderly parents. One in five of adults in their forties and fifties are supporting both a minor and an adult child at the same time. (No rest for the weary!)

Coping with Dual Caregiving Responsibilities

Being part of the sandwich generation brings unique stressors. Managing the emotional and financial responsibilities of caring for both children and parents can be overwhelming. So, how do these caregivers cope?

- Time Management: Prioritizing daily tasks and setting boundaries is essential. Many in the sandwich generation rely on structured schedules to balance work, family time, and self-care.

- Financial Planning: Dual caregiving can strain financial resources. Seeking professional financial advice can help individuals manage their current responsibilities while safeguarding their future, especially in terms of retirement planning.

- External Support: Hiring professional caregivers or seeking community services for elderly parents can help alleviate some of the burden. Additionally, many turn to technology—such as caregiving apps or virtual health monitoring tools—to streamline tasks and stay on top of both children’s and parents’ needs.

The Satisfaction Paradox: Finding Joy Despite the Juggle

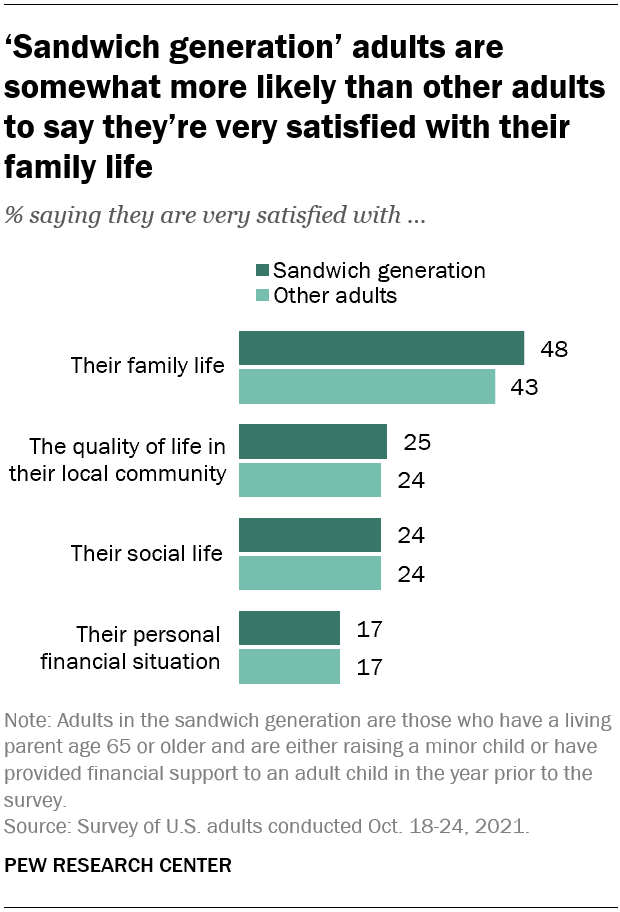

If you feel like you’re balancing too much, here’s an encouraging statistic: adults in the sandwich generation—especially those in their forties—report higher levels of satisfaction with their family life compared to other groups. Crazy, right? It seems that despite the stress, people find meaning and happiness in staying connected to both their children and parents.

However, in other areas—like social satisfaction and personal finances—the difference between sandwich generation members and other adults is less significant.

Multigenerational Living: A Growing Trend in Modern Households

With multigenerational households growing in popularity, about one in five adults—sandwiched or not—now lives with parents, children, or both. And though the rise of multigenerational living isn’t entirely new (we see similar percentages today compared to a 2014 survey), it remains an important part of American family life. As life expectancy increases and young adults face challenges in achieving financial independence, the sandwich generation phenomenon is likely to continue shaping family structures and caregiving responsibilities in the United States.

The sandwich generation will likely be a fact of life for many Americans in the years to come. While caregiving can be challenging, it’s clear that balancing family responsibilities, even at its most stressful, still brings its own rewards.

Feeling overwhelmed by the demands of caring for kids and aging parents?

You’re not alone! Let’s create a financial plan that fits your unique situation. Connect with an advisor and let’s find balance in your busy life!

Categories

Recent Insights

-

The Looming ACA Premium Tax Credit Cliff: How Families Can Manage Rising Healthcare Costs

Picture this: You finally have a handle on your healthcare costs. The numbers make sense. The plan fits. But a sudden change in policy could flip everything upside down. It can feel like the ground shifting beneath your feet. For many families, the potential expiration of enhanced ACA Premium Tax Credits at the end of…

-

Charitable Planning During a Liquidity Event: What to Consider Before You Sell

Liquidity events—selling a business, real estate, or a concentrated stock position—are rare moments that often define a business owner’s financial and philanthropic legacy. Before you sign the papers, thoughtful charitable planning can transform a tax liability into a purposeful legacy. The central rule is simple: start before the deal closes. Why timing matters When a…

-

When Love Ends, Who Keeps the Picasso? Dividing Art and Collectibles in Divorce

Divorce is never only about dividing assets. For many couples, the most difficult conversations don’t revolve around bank accounts or real estate—they center on the art, antiques, wine, or collectibles that hold both financial and emotional weight. Over the years, I’ve seen how these items often represent more than monetary value. They are memories, passions,…

-

Talk Your Chart | Market Reversals, AI Interdependence, and What Investors Should Know | Ep. 74

In episode 74 of Talk Your Chart, Brett Horowitz is joined by Lane Jones, Chief Investment Officer at Evensky & Katz / Foldes, to examine some of the most surprising market behaviors of 2025. They break down this year’s historic intraday reversals, why strong economic data can still trigger weak market reactions, and how rate-cut…

-

Combining Donor-Advised Funds and Private Family Foundations for Charitable Giving

When families embark on a philanthropic journey, they often consider whether to create a private family foundation (PFF) or establish a donor-advised fund (DAF). Both vehicles are powerful tools, each with distinct advantages. In practice, many families find that using both together can provide the flexibility, simplicity, and impact they seek. With careful planning, the…