Conquering Fear in Investing: Building a Resilient Portfolio for the Future

Understanding the Fear Response in Financial Decisions

“Neither a man nor a crowd nor a nation can be trusted to act humanely or think sanely under the influence of a great fear…To conquer fear is the beginning of wisdom.” – Bertrand Russell

Silly question—what’s riskier: nuclear reactors or sunlight?

The most devastating nuclear disaster in history happened at Chernobyl, Ukraine, in 1986. Early reports predicted tens of thousands of deaths. By 2006, the number was fewer than 100. Meanwhile, nearly 8,000 Americans die every year from skin cancer, primarily caused by overexposure to the sun.

Deep within your brain is the amygdala, a small, almond-shaped structure. This part of the brain triggers quick emotional responses like fear and anger when we encounter risk. These emotions serve as alarms, preparing us to act in the face of danger.

But why would the amygdala push us to feel fear before we even realize we’re afraid? Evolutionarily, this response was crucial—those who hesitated in the face of danger were less likely to survive. So, does the amygdala make us “irrational”? Not at all. It makes us human, and it likely played a significant role in ensuring our survival as a species.

Fear, the Market, and Why It’s Hard to Resist Panic

When the threat is financial, though, the amygdala’s reflex can work against us. A market drop can trigger this emotional flood, causing a gut reaction that feels like prudent risk management but is often driven by an instinct to escape danger—like running from a saber-toothed tiger.

This instinct is why you may feel the urge to pull out of the market at the first sign of a downturn. But ask yourself: why would you sell an investment you expect to thrive in the long term simply because of a temporary dip?

The market isn’t a saber-toothed tiger—it’s a natural cycle that rewards patience, not panic.

Why Predicting the Future Doesn’t Work: Lessons from History

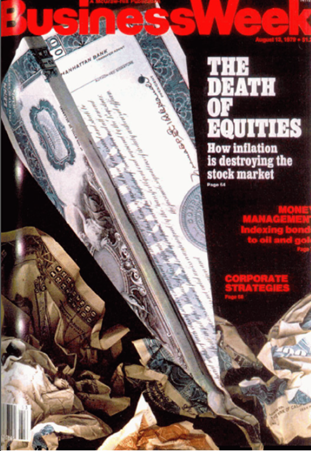

Take a look at August 13, 1978. The headline might seem alarming, but the 1970s were a tough decade for stock market returns. Similarly, the 2000s were another challenging period for investors. Bad decades are inevitable, but you can’t predict when they’ll come.

The key to surviving these difficult times isn’t panic—it’s resilience. There’s a timeless truth in investing: you can’t predict the future. Instead, you must build a portfolio that stands strong in the face of uncertainty.

What’s remarkable is that while stocks struggled in the ’70s, real estate outperformed, giving homeowners a positive real return. Similarly, international stocks, small-cap stocks, and real estate delivered strong returns in the 2000s. Diversification, it turns out, really is the only free lunch.

Building Resilience: How to Prepare for the Unexpected

So, how do you position your portfolio to weather any storm? It’s not about guessing the market’s next move—it’s about structuring your investments to thrive no matter what happens.

Here are six key principles to help you avoid emotional decision-making and ensure your portfolio is built to last:

- Define Your Portfolio’s Purpose: Every portfolio should have a clear, overarching goal that aligns with your life’s values and objectives. What do you want your investments to achieve?

- Set Realistic Return Expectations: Understand what you can reasonably expect from your investments over time. Keep in mind that markets fluctuate, and long-term growth is the true measure of success.

- Set a Time Horizon: The most successful investors think long-term. Are you planning for retirement, a future purchase, or generational wealth? Your time horizon will guide your investment strategy.

- Embrace Diversification: Diversification is a fundamental principle of resilient portfolios. Ensure that your investments span different asset classes to reduce overall risk.

- Define Your Approach to Rebalancing: Rebalancing ensures your portfolio stays aligned with your goals. Whether it’s annually or more frequently, develop a strategy to maintain your desired asset allocation.

- Establish Clear Performance Benchmarks: Set specific, measurable criteria to evaluate how your investments are performing. This helps keep emotional reactions in check and reinforces your commitment to the long-term strategy.

The Path Forward: Resilient Investing Through Behavioral Awareness

The key to great returns isn’t in outguessing the market—it’s in your ability to remain disciplined and resilient in the face of uncertainty. By understanding the psychology behind investing and following the principles outlined above, you can navigate market fluctuations and build a portfolio that supports your life goals.

Ready to align your portfolio with your values and goals? Connect with us today and start building your resilient financial future.

Categories

Recent Insights

-

Evensky & Katz / Foldes Wealth Management: Interview With Principal & Chief Revenue Officer David Evensky About The Advisory Firm

Evensky & Katz / Foldes Wealth Management is a registered investment advisory firm that provides comprehensive wealth management, financial planning, and investment advisory services to individuals, families, and institutions. Pulse 2.0 interviewed Evensky & Katz / Foldes Wealth Management Principal and Chief Revenue Officer David Evensky to gain a deeper understanding of the company.

-

Budgeting and Financial Organization: Lessons from Life, Love, and Messy Homes

Recently, my wife sent me an opinion article from The New York Times titled “My Home is Messy, and I Don’t Feel Bad About It” by KC Davis. The author highlights many reasons why being messy can be a positive trait—from fostering creativity to accepting that the same DNA that “makes us shine can’t be…

-

Talk Your Chart | 2026 Predictions: A Year in Review and a Look at the Year Ahead | Ep. 75

Episode 75 of Talk Your Chart kicks off the new year with Marcos and Brett revisiting their 2025 predictions to see what held up, what missed, and why. From stocks and bonds to GDP growth and Bitcoin, they break down the charts that mattered most and share their outlook for the year ahead. Charts available…

-

Private Family Foundations: A Legacy of Giving and a Classroom for the Next Generation

For families who want to make a lasting impact, a Private Family Foundation (PFF) can be both a philanthropic vehicle and a platform for teaching values across generations. At its core, a private foundation is a tax-exempt nonprofit organization that you create and control—one that supports the causes you care deeply about, both during your…

-

The Looming ACA Premium Tax Credit Cliff: How Families Can Manage Rising Healthcare Costs

Picture this: You finally have a handle on your healthcare costs. The numbers make sense. The plan fits. But a sudden change in policy could flip everything upside down. It can feel like the ground shifting beneath your feet. For many families, the potential expiration of enhanced ACA Premium Tax Credits at the end of…