Topics

Topic:

Client Services

-

The Best Travel Credit Cards of 2021

Tips from the pros: Finding and using the right travel credit card.

-

Lagniappe: Some Final Takeaways

The following is an excerpt from Chapter 23 of Hello Harold written by Harold Evensky. It has been adapted and edited for easier digital reading. I couldn’t resist using one of my favorite words—lagniappe. It means a little something extra given at no cost, somewhat like the thirteenth doughnut in a baker’s dozen. Because there…

-

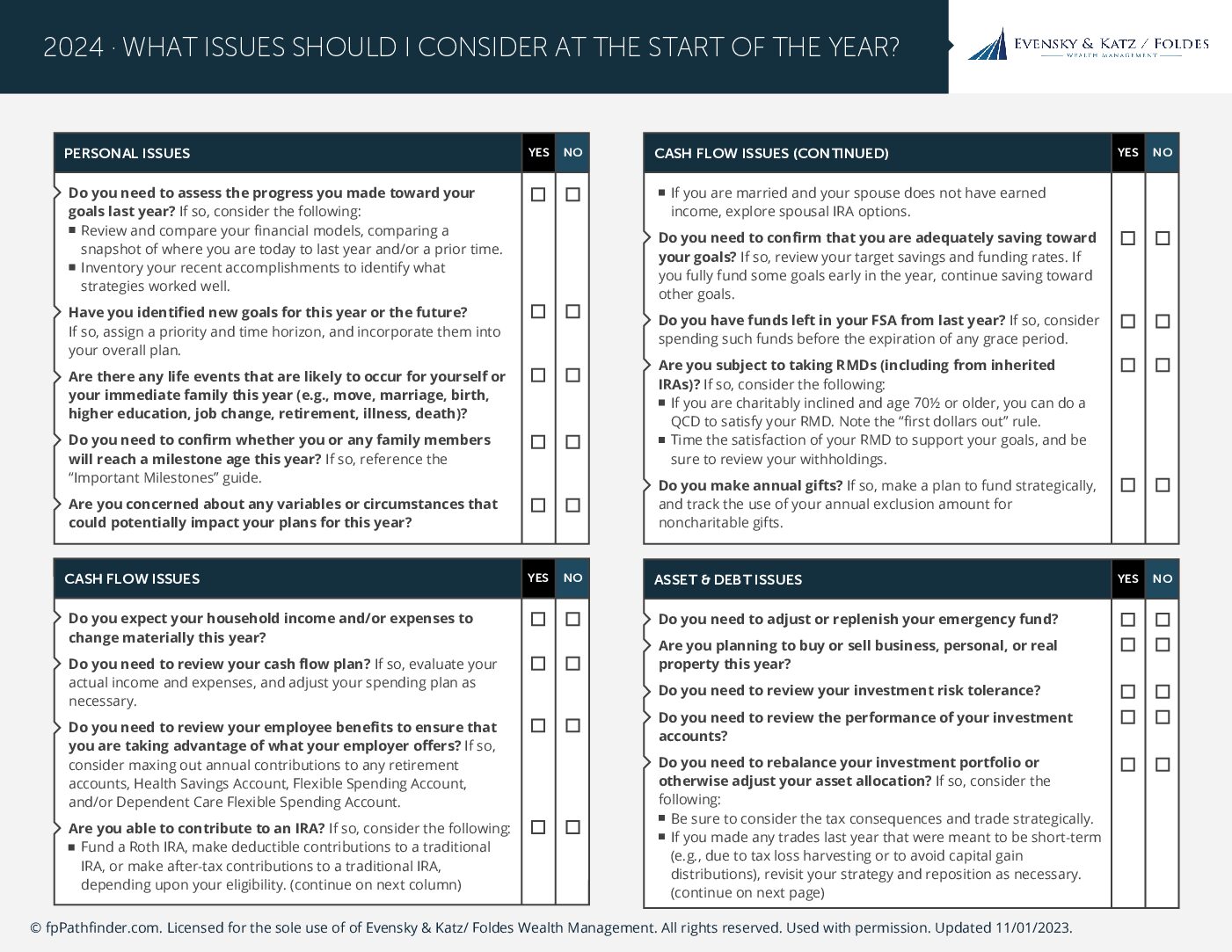

What Issues Should I Consider At The Start Of The Year? | 2024

The beginning of the year is an ideal time for a financial check-up. As you reflect on the past year and set resolutions for the future, this checklist will guide you through essential areas to review and improve. Key Areas Covered: Use this checklist to start the year with a clear financial plan and make…