Don’t Let Fear Drive Your Investment Strategy

Would you rather be in the market when it goes down or out of the market when it goes up?

Me neither!

In a perfect world, we would know how to get out of the market at the right time to avoid losses, then return at the ideal moment to capitalize on the recovery. Why wouldn’t someone want to do this? Can anyone do it consistently?

To help answer this last question, I propose the following exercise:

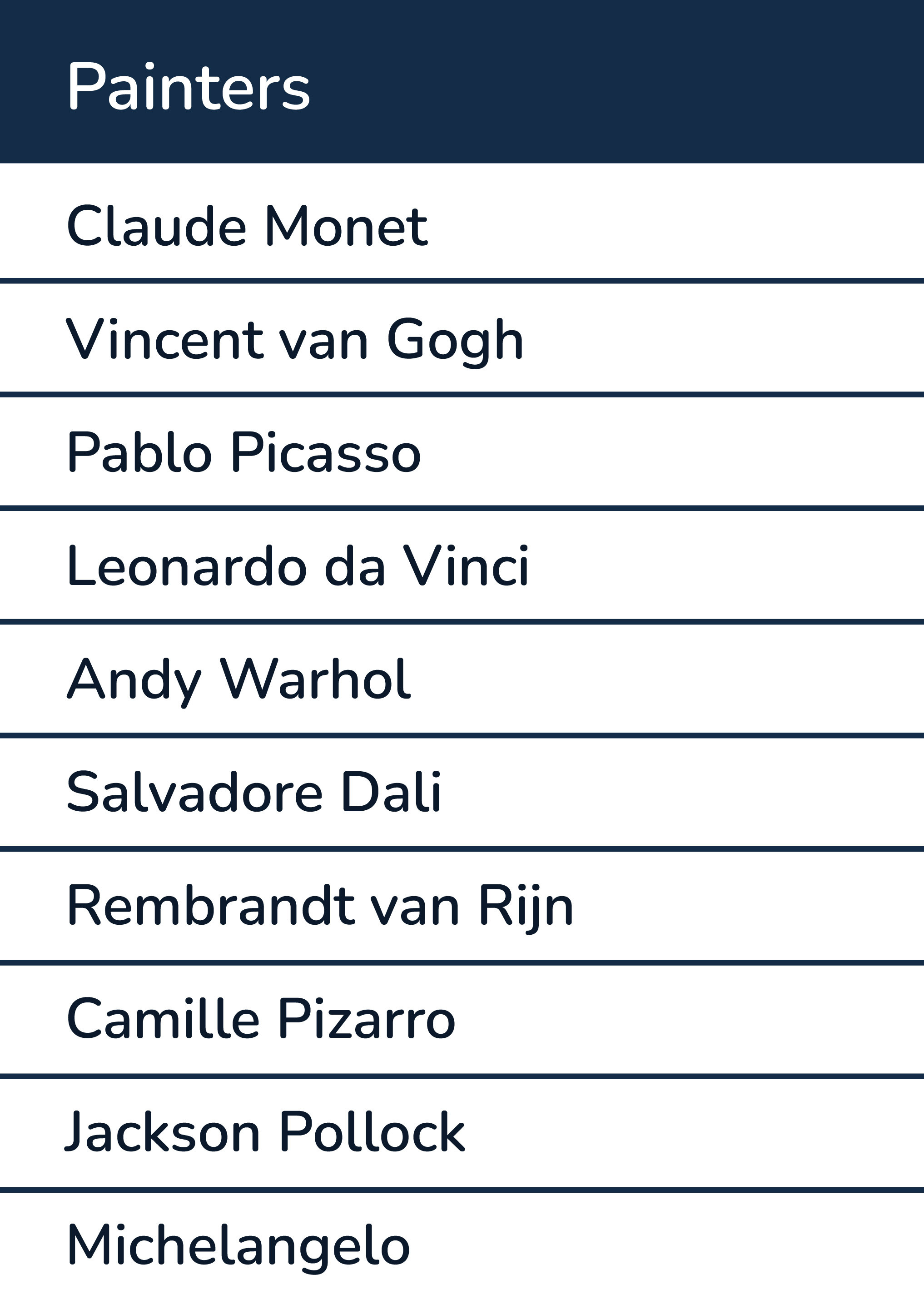

The two tables below list the names of individuals widely regarded as some of the best to ever participate in their respective sport or medium.

In the following table, list the names of the top ten market timers of all time. Market timing is defined here as selling out-of-market exposure to reinvest at a more attractive valuation.

Ok, how about the top five?

Top three?

This is not a trick question! How about the #1 market timer of all time?

I’m pretty sure I know how you did on this exercise, and the cap is likely still on your pen. But don’t worry, you are not alone. Our planners have nearly 300 years of combined investment experience, and we can’t name one either. The reason is that nobody can time the markets reliably and repeatedly, which is required to complete the strategy many investors still chase. Successful market timing requires two correct independent guesses; 1) when to sell out of the market and 2) when to buy back into it.

The decision to get out of the market might initially seem easy to make, as it often occurs when an investor “feels” negatively about the immediate future. The investor wishes to avoid owning investments that they “fear” will decline in value. Thinking back to the elevated volatility we endured during the financial crisis in 2007-2009, imagine that an investor feared a second shoe falling and sold out when the Dow Jones Industrial Average declined from a high of just over 14,000 to 9,000. What do you think that investor would likely have said when the DJIA then fell to 6,500? “This is perfect; now it’s my time to buy!” No, we didn’t hear much of that from the market timing crowd. Instead, it was forecasts of a 3rd shoe dropping. And then suddenly and dramatically, markets turned.

Market timing strategies ultimately fail because although the investor initially intends to reinvest at a lower level when prices are cheaper (i.e., when things feel worse), usually, they will end up waiting until recovery has begun and miss out on a good deal of the return (often getting back in at a higher point than when they sold!).

Important questions include: How are these reinvestment decisions made? Unfortunately, investors typically describe their criteria in vague and largely subjective terms, such as:

“I’m going to wait to get back into the market until I see that things look better.”

Whenever I hear this description, I ask for clarification or quantification of what it means for “things to look better.” By far, the most common answers I have heard include criteria like “markets stabilize” (are they ever stable?) or “the economy gets better.” Sometimes the answer includes a market measurement, e.g., “markets go back up around 10%.” (Let me get this straight, you are intentionally trying to miss out on 10% market growth?)

Even better questions include: What are the risks of timing it wrong? What factors and emotions are involved in the process?

Human behavior is largely based on emotion. Sadly, these emotions include fear and greed, which are detrimental to any investment program. Thankfully, you can remove fear and greed from your investment program by hiring a qualified investment advisor, preferably one who embraces fiduciary responsibility as we do at Evensky & Katz / Foldes Wealth Management.

Our value as investment advisors is to educate our clients, impart discipline and help them make prudent financial decisions. We frequently toil in the trenches with our clients, managing cash flow reserves, updating financial plans, modeling new scenarios, and helping clients determine if they are still on track to achieve their goals. We don’t begin performing these activities when times get tough; we simply perform them more often.

I want to emphasize that we do not live under a rock. and we certainly acknowledge that 2007-2009 was abysmal. 2022 wasn’t much fun, either. However, we remain confident in our core belief that, over time, world stock markets will go up. This is not to say that it won’t be rocky along the way, and we are not out of the woods just yet, but our disciplined approach to working with clients will help guide them through tough times.

To help illustrate the effect of investor psychology and human behavior on portfolio performance, let’s examine the experiences of three hypothetical investors who own a portfolio comprised of an S&P 500 index during the highly volatile period from September 30, 2008 through May 26, 2009 (shortly after the 2009 recovery began.) We could use more recent examples, but this period is a perfect backdrop for the conversation (that and it is far enough in the past now that we can talk about it without getting dizzy!).

Investor: Todd

Todd has always been a firm believer in long-term investing and typically invests in index funds rather than attempting to select individual stocks and bonds. He suffered heavy losses during the tech bubble, as had most of his friends and colleagues, and he had only recently begun to feel like his portfolio was on track again when the credit crunch of 2007 began.

Initially, Todd did his best to ignore the bad news and economic commentary during the end of 2007 and the beginning of 2008. However, by the summer of 2008, Todd’s frustration and fear had turned to desperation, panic, and even anger. His portfolio had fallen precipitously from its all-time high in October 2007, and it would be months before market recovery began. The decisions he would make over those coming months would substantially impact his financial outcome, perhaps permanently.

As this table illustrates, his results are dreadful. He lost over 60% of his portfolio, and he is still not invested. Yet during the remainder of the year, markets continued their strong rebound, leading toward the fastest recovery in history. Based on where we left off with Todd, how long would it have taken before he felt comfortable to reinvest in stock markets?

Investor: Rachael

Like Todd, Rachael is also a long-term investor and believes in more passive strategies such as indexing. Rachael understands that to earn market returns over time, she must be in the market, even though the value of her portfolio may fluctuate substantially along the way.

Despite sharing a similar long-term view with Todd, Rachael handled the recent period from September 30, 2008 to May 26, 2009 differently. Rachael remained invested throughout the period, correctly figuring that an attempt to time the market would likely work out to her detriment.

In Todd’s hypothetical scenario, his portfolio value fell from $1,000,000 to $394,627 due to his incorrect market timing decisions, while Rachael’s declined from $1,000,000 to $781,450.

That’s a whopping difference, but imagine how big a difference that makes going forward! Suppose that Todd bought back in on May 29, 2009, and he and Rachael remained invested through the recent market close on January 27, 2023 with no portfolio additions or withdrawals.

As you can see, the result is massive, with Rachael’s portfolio worth more than $2.7 million more than Todd’s. Rachael’s discipline when times were tough contributed handsomely to her success.

Now let’s take a look at the third scenario, involving an investor who made all the correct timing decisions during the period.

Investor: None

Moving on…

While these scenarios are admittedly a bit over the top as they assume that Todd sold out and subsequently bought back in at the worst points during the time, they serve as hypothetical examples of the potentially catastrophic effects of making poor decisions under this type of stress! While it is unlikely that you, as investors, know someone who made Todd’s exact trades, it is very likely that you know someone who followed some portion of this pattern as opposed to remaining invested.

Most importantly, you are unlikely to know someone who sold at the high points and successfully repurchased at the low points. If you do know someone, they are pulling your leg.

Despite the significant challenges of 2007-2009 and through volatile periods like the debt ceiling uncertainty in 2011, the 4th Quarter of 2018, the first half of 2020, and most of 2022, we continue to believe strongly that over time, world equity markets will go up. Maintaining discipline and making prudent investment decisions, though admittedly easier said than done, is the most reliable formula for persevering in difficult times.

Today, in early 2023, the war in Ukraine, inflation, interest rates, Fed action, and an impending recession dominate the headlines. Back in March of 2009, financial pundits claimed that long-term buy-and-hold strategies (we buy and manage) were dead and that the only viable strategy was to time trades right and take gains where feasible. Yet, March of 2009 ignited a powerful recovery, and investors who owned stocks for the long term were rewarded yet again. The S&P 500 index that had closed on March 9, 2009 at 676.53 (and where long-term investing was supposedly dead) closed recently on January 27, 2023 at 4,070.56. It has closed as high as 4,796.56. Disciplined long-term investing is not dead after all! Our hypothetical investor, Rachael, pointed out that she must remain in the market to earn market returns over time. Said another way, the key is not timing the market but rather time IN the market!

Categories

Recent Insights

-

Talk Your Chart | 2026 Predictions: A Year in Review and a Look at the Year Ahead | Ep. 75

Episode 75 of Talk Your Chart kicks off the new year with Marcos and Brett revisiting their 2025 predictions to see what held up, what missed, and why. From stocks and bonds to GDP growth and Bitcoin, they break down the charts that mattered most and share their outlook for the year ahead. Charts available…

-

Private Family Foundations: A Legacy of Giving and a Classroom for the Next Generation

For families who want to make a lasting impact, a Private Family Foundation (PFF) can be both a philanthropic vehicle and a platform for teaching values across generations. At its core, a private foundation is a tax-exempt nonprofit organization that you create and control—one that supports the causes you care deeply about, both during your…

-

The Looming ACA Premium Tax Credit Cliff: How Families Can Manage Rising Healthcare Costs

Picture this: You finally have a handle on your healthcare costs. The numbers make sense. The plan fits. But a sudden change in policy could flip everything upside down. It can feel like the ground shifting beneath your feet. For many families, the potential expiration of enhanced ACA Premium Tax Credits at the end of…

-

Charitable Planning During a Liquidity Event: What to Consider Before You Sell

Liquidity events—selling a business, real estate, or a concentrated stock position—are rare moments that often define a business owner’s financial and philanthropic legacy. Before you sign the papers, thoughtful charitable planning can transform a tax liability into a purposeful legacy. The central rule is simple: start before the deal closes. Why timing matters When a…

-

When Love Ends, Who Keeps the Picasso? Dividing Art and Collectibles in Divorce

Divorce is never only about dividing assets. For many couples, the most difficult conversations don’t revolve around bank accounts or real estate—they center on the art, antiques, wine, or collectibles that hold both financial and emotional weight. Over the years, I’ve seen how these items often represent more than monetary value. They are memories, passions,…