Harold Evensky’s musings on the Coronavirus.

I know that “experts” on what’s happening in the world have inundated you (and me) with pontifications, but I can’t resist putting my two cents in too, so I’ll start with the obvious. It’s scary as hell out there and with good reason. Covid-19 is expanding at a geometric rate, global economies are being decimated, and markets are in free fall. Deena teases me about how often I reference the old Chinese curse “May you live in interesting times,” but this time does seem to be the mother of “interesting times!” You might ask: Is there any good news? I believe the answer is Yes! Panic, Perspective, Patience, and Planning (and possibly Prayer, but I will leave that to you and a higher authority).

PANIC

Panic and fear are natural consequences of the Covid-19 scourge and the media seem to love to feed this emotional tsunami. Fear can often be a useful guide steering us away from unnecessary risk; however, when unconstrained as it is today, it usually leads to panic. In the investing universe, that is a recipe for disaster. The antidote is reasonable hope that provides “the wisdom to take reasonable risks and the power to persist in adversity.” I believe Perspective, Patience, and good Planning will help you develop reasonable hope.

PERSPECTIVE

As I’ve often reminded clients during times of scary markets, long term there are only two possible outcomes: #1. There is no light at the end of the tunnel and the world will come to an end. In that event, all bets are off and it will not matter what you do. #2. There is light at the end of the tunnel, the world will not come to an end and eventually the world economy and markets will recover.

We’ve been there, done that. Consider just a few examples.

The Bear Market of 1973–1975. Between January 1974 and February 1975, the market lost 49% of its value.

Black Monday on October 19, 1987. This was a sudden, severe stock market crash that struck the global financial market system and caused havoc. In ONE day, the Dow Jones Industrial Average fell 22.6%. It’s still the largest one-day percentage drop in Dow Jones history.

The 1990 Recession. Stocks trended higher in the eight years prior and peaked two weeks after the recession began. Early in the recession, stocks declined, losing 26% until eventually bottoming out.

The Great Recession (12/07–6/09). This recession brought the worst economic contraction since The Great Depression, ultimately losing almost 54% from peak to trough.

PATIENCE

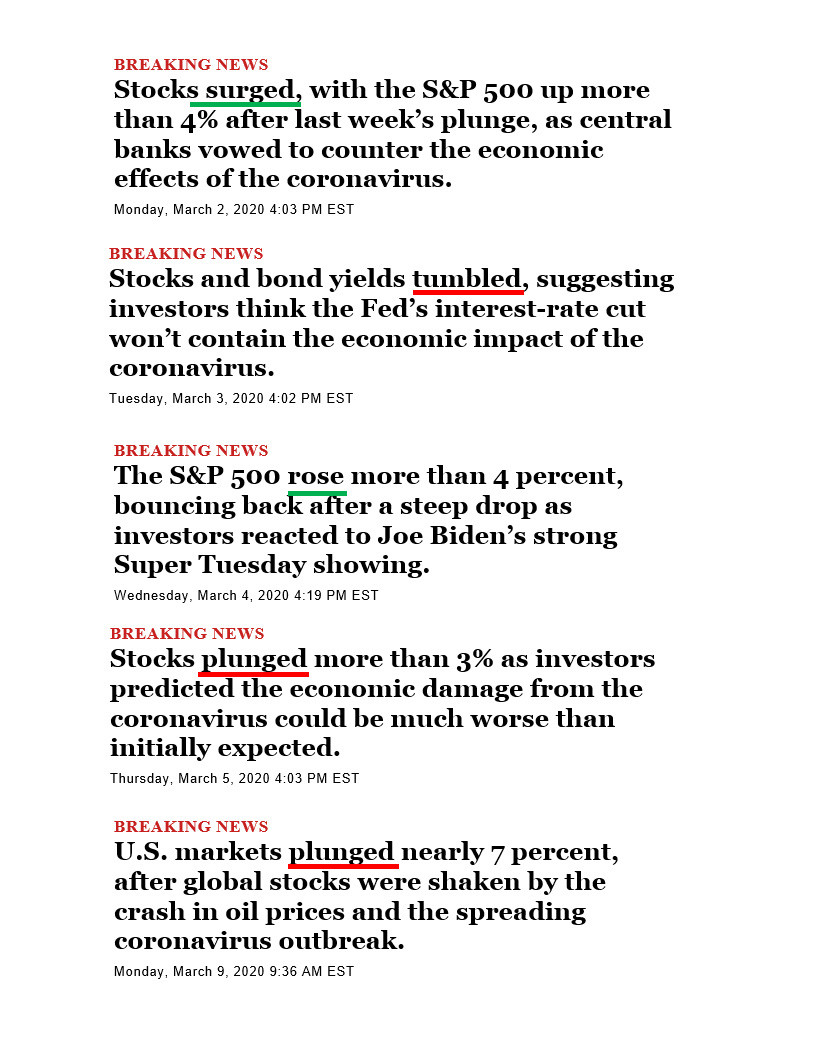

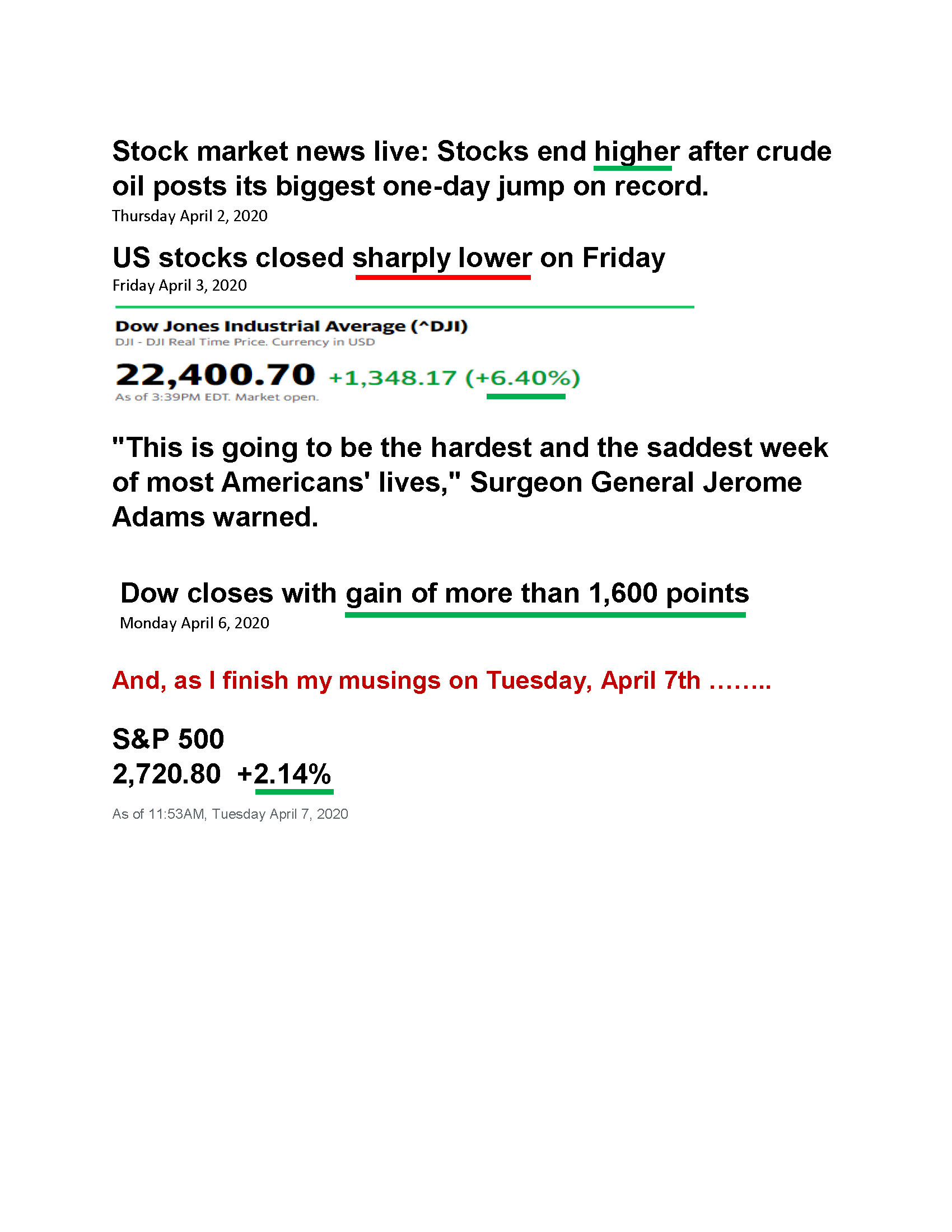

We are indeed living in a chilling and scary time now. With minute–by-minute news flashes on the growing number of new Corona cases and related deaths and new “stay-at-home” orders. The markets reflect this reality with schizophrenic volatility (take a look at my “FINANCIAL PORNOGRAPHY; DO YOU REALLY WANT TO MARKET TIME?” at the end of my musings).

This reality makes it mighty hard not to be tempted to bail out. Although the decision is always yours, our STRONG recommendation is DON’T DO IT! I know you’ve heard it before, but it’s true. Centuries of experience demonstrates that those who bail, fail; those who stay, succeed.

Here’s a picture showing the rewards of Patience.

Of course, that begs the question: Why not just step aside for a bit and simply get back in when the world regains its sanity? This strategy is known as “market timing”. If I asked you to name the 10 best market timers of all time, I have no doubt your response would be silence. How about the top 5? Top 3? Even the top 1? Still silence. The reason is, in hundreds of years of market history, no one has yet to find that pot of gold at the end of the rainbow. Besides, if anyone really could consistently market time, would they bother telling you about it or just sit back and make themselves rich?

The unfortunate reality is that to earn market returns over time you need to remain in the market over time. Why? Market returns do not come like clockwork but rather in spurts when you least expect it. As an example, here’s a simple chart that shows how much returns you would lose by missing only a few days during the period January 1, 1970, to July 31, 2019 – that’s 50 years or 18,108 days!

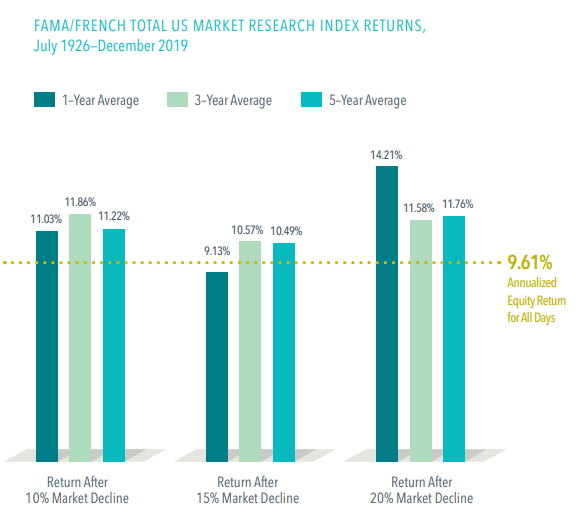

What do the returns after serious market declines look like? Pretty damn good. Here’s a table from DFA.

Remember, market timing requires not one but two right decisions. You not only have to decide when to bail, but here’s the rub, when to get back in! The problem with market timing is those “best days” occur while timers are waiting for a “confirmation” that the market has recovered.

Besides, as DFA points out, “Responding to the latest news and exiting the market may not alleviate anxiety. Markets fluctuate daily in response to news and sometimes they experience significant declines. This can create anxiety for investors. However, exiting the market and then watching a subsequent rebound in stock prices can be just as unnerving. In this case, the stress of being in the market is replaced by the stress of being out of the market.” If in doubt, take a look once again at my Do You Really Want To Market Time.

The moral is, with Patience and good Planning, by remaining committed to your investment policy, in hindsight you will, through rebalancing and good cash flow management, have likely taken advantage of one of the best investment opportunities for the last century (remember, OVER THE LONG TERM).

PLANNING

I know that one of the most frightening elements of today’s chaos is the feeling of lack of control. While it’s true that there is much we cannot control, the good news is there is much we can.

Tune Out the Noise.

The simplest and perhaps most powerful thing you can do is to simply stop watching, listening, and reading the financial pornography available second by second, 24 hours a day on TV, radio, and in publications. Remember if those commentators were really so all-knowing, they wouldn’t bother working for a living. Especially the television gurus. Why on earth would you want to have two half pounds of makeup plastered on your face and sit under hot lights for hours when you could simply get rich by predicting future market moves.

Revisit your plan and modify it if necessary.

Hopefully, your investments and investment policy are based on thoughtful planning. For example, in our practice, our planning of clients’ investment policies (i.e., their investment roadmap) are based on guidance developed with the use of our proprietary version of MoneyGuide Pro, the leading institutional personal planning software. This incorporates our clients’ goals, financial resources, and risk tolerance. It also incorporates our long-term expectations for market returns and volatility. However, as sophisticated as this process is, it is still based on reasonable expectations and not guarantees; consequently, in times like these it’s important to revisit these elements. If you’ve planned in advance and utilized cash flow management strategies, such as our cash flow reserve, you may well find that you are reasonably well positioned to weather this financial tsunami without having to sell into a plummeting market. Should that not be the case, the sooner you are aware that adjustments need to be made the more likely those adjustments will be modest. In any event, with a reasonably clear picture of your current position, you’re likely to sleep better than if you’re living in a fog of uncertainty.

Use realistic expectations.

When updating your planning, use realistic expectations. Expected market returns in the short and near term may be pretty depressing; however, as I noted earlier in my comments, assuming the end of the world long term is not likely to be useful. In fact, as the history of recoveries in the past has shown, the future is looking good.

Why do you need to stay invested in the market? In order to meet all of your goals factoring in taxes and inflation, unless you have enough money that you can afford to bury it in the backyard, you’re likely to need a return on your investments higher than you’ll earn with cash or bonds. As a consequence, in planning, your mortality assumptions are critical. When working, the risk to your family is you dying early. In retirement, the risk is not dying and still needing to eat. Even someone 70 years old today has a long planning horizon. Here are some examples from Moneyguide.

WHAT ELSE DO YOU HAVE CONTROL OVER? YOUR PORTFOLIO DIVERSIFICATION.

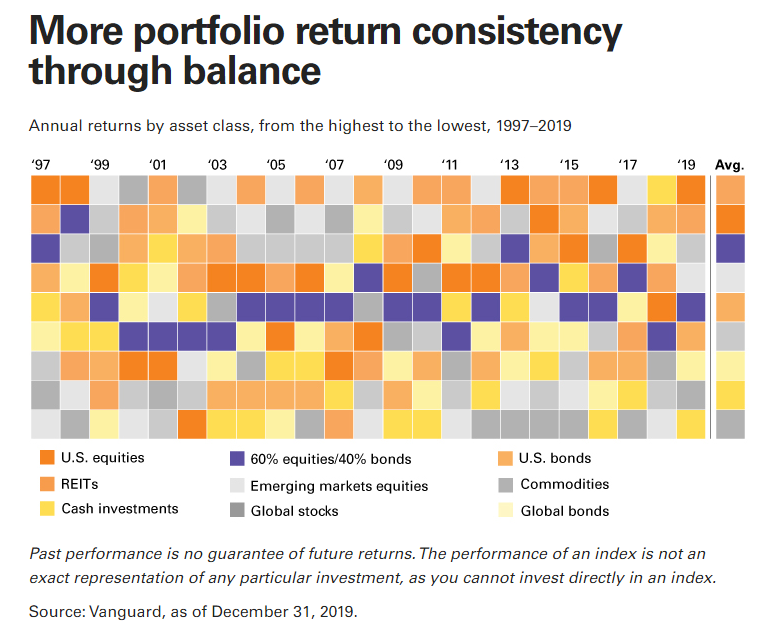

The key is to be smart, not brilliant (remember, “brilliant” market timers always lose). A well-diversified portfolio over time will never provide the highest return, but it will not provide the lowest. Over time, it will be the most consistent with the lowest risk per unit of return. As an example, below is a Vanguard chart showing the annual returns of a 40% bond/60% stock portfolio compared to individual asset class investments.

REBALANCING

We know that watching your portfolio’s returns go up and down can be gut wrenching; however, we also know that, over time, rebalancing helps mitigate the risk of short-term market volatility. Again, borrowing from some of Vanguard’s excellent presentations, below are a few graphs demonstrating the value of rebalancing.

In addition, over time, non-rebalanced portfolios will trend toward much higher stock allocations.

Caveat! While “rebalancing” sounds great, in reality it means selling what is going well (or at least not a disaster) and buying investments others are running from. In today’s environment, that means selling bonds and buying stock. However, in the long run (remember the mortality discussion), it means buying low and selling high.

As Vanguard concludes, “Rebalancing can also be combined with and complement other strategies, such as tax-loss harvesting. Vanguard research shows that advisors can add appreciable value over time, through activities such as rebalancing and behavioral coaching in general.” All of which we do.

I thought I’d close with a wonderful story our Rabbi shared with us that sums this all up.

King Solomon, for reasons unknown, decided to send the servant who loved him most on an impossible quest. King Solomon told this servant that he wanted a ring that would cheer him up when he was feeling down, and would calm him down when he was too excited. King Solomon gave his servant one year to find the ring.

The servant thought nothing of the mission. Whatever King Solomon desired, he was honored to procure and serve. So off the servant went on his mission. The servant travelled all over the world, looking for the powerful ring that could control the strongest of emotions. The servant walked into every jewelry shop he could find: from the fanciest and richest of the stores in Paris to the smallest and humblest of jewelry shops in the middle of nowhere towns. Every shop owner sent the servant away laughing or insulted – jewelry shops were no place for magic!

As the servant’s deadline was coming to an end, he was feeling disheartened. But, he didn’t give up. Any time he saw a jewelry shop, he’d go in to inquire whether they had a ring that could calm and humble our proud moments, and cheer us up in the darkest of hours. But even with the pressing deadline, there was no luck.

Finally, the day arrived when the servant had to return to King Solomon. As the servant approached the palace, he saw one last and tiny jewelry shop. With nothing to lose, the servant walked into the shop, “King Solomon desires a ring that will lift his moods in times of sorrow, and soothe the elated moments.” Mostly expecting yet another jewelry maker to laugh in his face, the servant asked, “Do you have such a ring?”

The jeweler, without any hint of contempt or sarcasm, thought for a minute and responded, “Yes, I do. Please wait here.” The jeweler went to the back of the shop where the servant couldn’t see him. The servant could hear the jeweler banging and working away. When the jeweler finally came out, the ring was wrapped in such a way that the servant had no idea what the ring looked like. As the servant was out of time and had nothing else to present to King Solomon, off he ran to the palace. (Side note: The shop still exists and you can still purchase the ring.)

At the palace, King Solomon was waiting for his loyal servant. King Solomon was feeling pretty smug. He knew the servant would come back empty-handed because he had sent the servant on an impossible mission.

When the servant arrived with a small box in hand, King Solomon was surprised. He opened the box and upon seeing the ring, he began to cry. While he was sure he had sent his servant on an impossible mission, his servant did indeed find a ring that humbled him in his moment of smugness, and would certainly cheer him up in dark moments to come.

I’m sure you are wondering what made the ring so special. Inscribed in the ring were the words, gam ze yavo: “This too shall pass.”

I hope you’ve found my musings useful. If you’d like to read further, below are some of the references I found useful. In the interim, stay safe and wash your hands.

Harold R. Evensky

Founder

Evensky & Katz/ Foldes Financial Wealth Management

References:

https://advisors.vanguard.com/iwe/pdf/ISGQVAA.pdf

https://advisors.vanguard.com/iwe/pdf/ISGQVAA.pdf

https://www.avantisinvestors.com/content/avantis/en/insights/fear-is-normal-dont-panic.html

Important Disclosure

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Evensky & Katz / Foldes Financial Wealth Management (“EK-FF”), or any non-investment-related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from EK-FF. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. EK-FF is neither a law firm, nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of EK-FF’s current written disclosure Brochure discussing our advisory services and fees is available upon request. Please Note: If you are an EK-FF client, please remember to contact EK-FF, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. EK-FF shall continue to rely on the accuracy of information that you have provided.

Categories

Recent Insights

-

The Looming ACA Premium Tax Credit Cliff: How Families Can Manage Rising Healthcare Costs

Picture this: You finally have a handle on your healthcare costs. The numbers make sense. The plan fits. But a sudden change in policy could flip everything upside down. It can feel like the ground shifting beneath your feet. For many families, the potential expiration of enhanced ACA Premium Tax Credits at the end of…

-

Charitable Planning During a Liquidity Event: What to Consider Before You Sell

Liquidity events—selling a business, real estate, or a concentrated stock position—are rare moments that often define a business owner’s financial and philanthropic legacy. Before you sign the papers, thoughtful charitable planning can transform a tax liability into a purposeful legacy. The central rule is simple: start before the deal closes. Why timing matters When a…

-

When Love Ends, Who Keeps the Picasso? Dividing Art and Collectibles in Divorce

Divorce is never only about dividing assets. For many couples, the most difficult conversations don’t revolve around bank accounts or real estate—they center on the art, antiques, wine, or collectibles that hold both financial and emotional weight. Over the years, I’ve seen how these items often represent more than monetary value. They are memories, passions,…

-

Talk Your Chart | Market Reversals, AI Interdependence, and What Investors Should Know | Ep. 74

In episode 74 of Talk Your Chart, Brett Horowitz is joined by Lane Jones, Chief Investment Officer at Evensky & Katz / Foldes, to examine some of the most surprising market behaviors of 2025. They break down this year’s historic intraday reversals, why strong economic data can still trigger weak market reactions, and how rate-cut…

-

Combining Donor-Advised Funds and Private Family Foundations for Charitable Giving

When families embark on a philanthropic journey, they often consider whether to create a private family foundation (PFF) or establish a donor-advised fund (DAF). Both vehicles are powerful tools, each with distinct advantages. In practice, many families find that using both together can provide the flexibility, simplicity, and impact they seek. With careful planning, the…