Maximizing Wealth: The Power of Tax Deferral

In the realm of personal finance, one of the most powerful strategies for wealth accumulation is tax deferral. This savvy financial move empowers you to delay paying taxes on your investment gains or income until a later date, giving you the upper hand in bolstering returns and safeguarding your capital for the future. Let’s delve into the perks of tax deferral and how it can pave the way for your financial success.

The Marvel of Compounding Growth

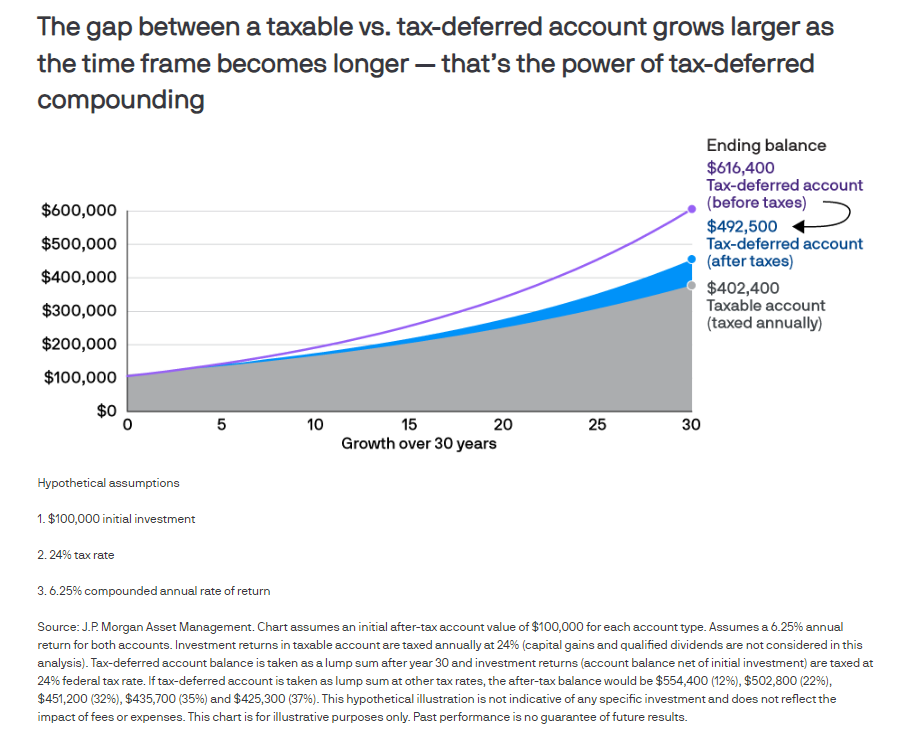

Tax-deferred vehicles like retirement accounts—think 401(k)s, IRAs, and annuities–help amplify compounding growth by allowing your earnings to grow without the burden of annual tax liabilities. The longer your funds stay invested, the more profound the compounding effect becomes, resulting in exponential growth over the life of your investment.

Higher Returns

Tax deferral allows you to keep a larger portion of your investment returns working in your favor. Without the drag of annual taxes, every penny of your earnings gets reinvested, making way for potentially higher-yielding returns than taxable accounts. This advantage becomes even more pronounced over extended investment periods.

To illustrate, here is an example of how the withdrawal value of a tax-deferred account would compare to a taxable account if you were to invest $10,000 annually (assuming a 7% annual return, compounded over 20 years):

https://www.aarp.org/work/retirement-planning/taxable_vs_tax_deferred_calculator.html

Lower Current Tax Liability

With tax deferral, you can trim down your current tax bill, especially during high-income years. Contributions to tax-deferred accounts often qualify for tax deductions, further whittling down your taxable income. This not only frees up more capital for investment but also has the potential to slide you into a lower tax bracket, lightening your overall tax load.

Flexibility in Retirement Planning

Tax-deferred accounts aren’t just about building wealth for your golden years—they’re also a strategic tool for estate planning. Inherited retirement accounts often come with a “stretch” provision, allowing beneficiaries to prolong the tax-deferred status over their lifetimes. This paves the way for a tax-efficient transfer of wealth to future generations, ensuring that your assets continue to grow and thrive.

Learn more about your options for an inherited IRA.

Diversification Opportunities

Tax-deferred accounts open the door to a wide range of investment options, from stocks and bonds to mutual funds and exchange-traded funds (ETFs). This diversity empowers you to craft a well-balanced investment portfolio tailored to your risk tolerance and financial objectives. With tax deferral on your side, you can focus on maximizing returns without worrying about the immediate tax implications.

Learn about capitalizing on tax diversification.

Hedging Against Future Tax Changes

Tax laws are anything but static, which means that future tax rates may fluctuate unpredictably. Tax deferral provides a hedge against potential hikes in tax rates by allowing you to postpone taxes until a later date when rates may be more favorable. This proactive approach ensures that you’re not caught off guard by sudden changes in the tax landscape.

Take, for example, if your tax rate went up due to an income increase or a change in the tax law—you could wait until retirement or until a more favorable tax law applies to you before taking any major withdrawals

Deferred Taxes, (Almost) Immediate Gratification

In conclusion, tax deferral is a powerful wealth-building tool that offers numerous advantages for investors. By harnessing the benefits of compounding growth, reducing current tax liabilities, and providing flexibility in retirement and estate planning, tax-deferred accounts empower individuals to maximize their wealth over the long term.

Tax deferral isn’t just a strategy for the distant future; it allows you to retain more of your hard-earned money today and keep it working for you. By deferring taxes on your investments, you unlock the power of compounding growth, providing a solid foundation for your financial future. With tax-deferred accounts, you can watch your wealth grow while enjoying the benefits of reduced current tax liabilities. So, embrace the strategy of deferred taxes and seize the opportunity for (some) immediate gratification on your journey toward wealth accumulation.

Looking for more information on tax deferral? Connect with an advisor today!

Categories

Recent Insights

-

Is FIRE Still Realistic?

The modern FIRE movement may be less about quitting work and retiring, and more about buying back your time.

-

Evensky & Katz / Foldes Wealth Management: Interview With Principal & Chief Revenue Officer David Evensky About The Advisory Firm

Evensky & Katz / Foldes Wealth Management is a registered investment advisory firm that provides comprehensive wealth management, financial planning, and investment advisory services to individuals, families, and institutions. Pulse 2.0 interviewed Evensky & Katz / Foldes Wealth Management Principal and Chief Revenue Officer David Evensky to gain a deeper understanding of the company.

-

Budgeting and Financial Organization: Lessons from Life, Love, and Messy Homes

Recently, my wife sent me an opinion article from The New York Times titled “My Home is Messy, and I Don’t Feel Bad About It” by KC Davis. The author highlights many reasons why being messy can be a positive trait—from fostering creativity to accepting that the same DNA that “makes us shine can’t be…

-

Talk Your Chart | 2026 Predictions: A Year in Review and a Look at the Year Ahead | Ep. 75

Episode 75 of Talk Your Chart kicks off the new year with Marcos and Brett revisiting their 2025 predictions to see what held up, what missed, and why. From stocks and bonds to GDP growth and Bitcoin, they break down the charts that mattered most and share their outlook for the year ahead. Charts available…

-

Private Family Foundations: A Legacy of Giving and a Classroom for the Next Generation

For families who want to make a lasting impact, a Private Family Foundation (PFF) can be both a philanthropic vehicle and a platform for teaching values across generations. At its core, a private foundation is a tax-exempt nonprofit organization that you create and control—one that supports the causes you care deeply about, both during your…