Evensky & Katz / Foldes Wealth Management

PORTAL ACCESS ACKNOWLEDGMENT

As a client of Evensky & Katz / Foldes Wealth Management (“Company”), by selecting the “I Agree” button, I elect to participate in the password-protected access portion of the Company’s Internet web site. I understand that my participation will allow me to review certain investment-related information published by the Company and unaffiliated third parties. This password-protected access is made available to clients of the Company free of charge. This authorization shall continue until canceled in writing.

I understand that the password-protected section is a secure web site intended only to allow a client access to information relative to his/her/its specific account. I also understand that I will be assigned an individual password. I agree not to share my password with any other person. I hereby release and hold the Company harmless from any adverse consequences relative to any failure by me to keep the identity of my password secure.

Evensky & Katz / Foldes Wealth Management

PORTAL ACCESS ACKNOWLEDGMENT

As a client of Evensky & Katz / Foldes Wealth Management (“Company”), by selecting the “I Agree” button, I elect to participate in the password-protected access portion of the Company’s Internet web site. I understand that my participation will allow me to review certain investment-related information published by the Company and unaffiliated third parties. This password-protected access is made available to clients of the Company free of charge. This authorization shall continue until canceled in writing.

I understand that the password-protected section is a secure web site intended only to allow a client access to information relative to his/her/its specific account. I also understand that I will be assigned an individual password. I agree not to share my password with any other person. I hereby release and hold the Company harmless from any adverse consequences relative to any failure by me to keep the identity of my password secure.

Videos

Reading List

Experts' Advice About Choosing Between 401(k) and Life Insurance

Presented by the Foundation of the Greater Miami Jewish Federation and Create a Jewish Legacy Miami

Expert Advice on Home Insurance in Florida

Harold Evensky, 80, long saluted as “The Dean of Financial Planning,” created at least two well-known and widely adopted investing strategies.

Expert Insight for Beginner Rental Property Investors

Tips from the pros: Finding and using the right travel credit card.

It comes down to what type of owner you are. Do you like to hold onto your car for years or switch it out frequently? Do you drive a lot of miles? Do you dislike paying for comprehensive insurance? How you answer could help steer your decision.

Whose name is on the title to the house? Is the person paying child support covered by a life insurance policy? Have you changed your tax withholding now that you won’t be filing as married? These are all important but often forgotten details.

Hurricane season officially began on June 1, and it runs through Nov. 30. So get ready now, in the calm before the storms.

Should you buy long-term care insurance or save up to self-insure? There are many trade-offs to consider. And, surprise: It doesn’t have to be one or the other. Your strategy over the years can change, depending on your needs and your finances.

You might think your home and auto insurance offer more than enough coverage, but if you’re wrong, one very bad day could wipe out your wealth. That’s what an umbrella policy is designed to prevent.

Long-term investors with diversified nest eggs have little to fear from the GameStop saga.

“If the recent volatility has you reaching for Tums, you’re doing it wrong,” says Brian Fischer, a financial advisor in Miami with Evensky & Katz. “It’s time to rethink your investment. You may want to reduce the size. Investing when your mind isn’t right leads to poor decision-making.”

“For folks that need cash, we’re proactive about having that set aside,” said Brian Fischer, senior financial adviser at Evensky & Katz Foldes Financial. “But what is in the market is money that will be needed over the long term of the next 15, 20 or 30 years.

I am 57. I have saved nothing. It always seemed like there would be time but…here I am. I’m a Registered Nurse and make $80,000 a year. I’m thinking I could work the next 10 years and save half my salary — five more years full time and two more years part time, at which time I will be 64. That would get me about $400,000 to retire. Not much. I am tired — nursing is a hard job. I am a nurse manager but it is a mentally stressful job. I need a plan.

Brett Horowitz, a certified financial planner at Evensky & Katz in Coral Gables, Fla., told Yahoo Finance that his firm is always looking to rebalance clients’ portfolios when they deviate from target allocations — for any reason. Back in early 2020 when the markets were at all-time highs, Horowitz said they rebalanced many portfolios to target allocations and used the opportunity to make sure people had appropriate emergency funds.

Once you’ve completed your vetting, interview a prospective CFP. If you’re seeking investment advice, ask the planner to describe his or her philosophy and how it will be put into practice, says Harold Evensky, a CFP and founder of Evensky & Katz/Foldes Financial.

What is the bucket strategy? Bucket strategy was introduced in 1985 by financial planning expert, Harold Evensky. Under this approach, the retirement portfolio is divided into three accounts, which are referred to as buckets. Retirement assets are allocated to each bucket in a predetermined proportion. The risk and returns associated with each bucket are different. While one bucket is responsible for maintaining income stability, other buckets offer growth in investment. This strategy is an amalgamation of security, control, and growth of investment for retirement. The bucket approach is adopted to ensure that the inflation rate is taken into account at regular intervals. In addition to this, growth in investment is used to fund the lifestyle of the investor upon retirement.

Planning based on current tax law is the norm for financial adviser Danqin Fang, of Evensky & Katz/Foldes Financial Wealth Management. However, the gap between the November election and taking office in January 2021 could present some planning opportunities, Fang wrote. “An increase in capital gains rates that was not retroactive could lead us to realize gains depending on the amount of the increase and the client’s particular situation,” Fang said. For example, “you may not want to accelerate gains for an 84-year-old client, considering the step up in basis his heirs would receive at death.”

For millions of Americans the economic disruptions caused by the coronavirus outbreak have highlighted the importance of emergency savings. One problem: With interest rates near record lows, finding a great place to keep that money is harder than ever.

Asian-Americans generally value education, are good at savings and legacy planning, and have a collective mindset to include extended family and multiple generations. When it comes to investing, Asian-Americans make the same behavioral mistakes, with the same emotional biases, as any other ethnic groups. However, it is always a great learning opportunity to recognize and demystify the common investing biases and beliefs many Asian-Americans share.

It’s time for pre-retirees to start taking concrete steps. For many pre-retirees or those entering retirement, the repercussions of COVID-19 and market turbulence have added new fears to their financial future. Yet this is the very time for these investors to carefully prepare for the future.

Harold Evensky, Founder/Evensky & Katz. Us Army Medical Services Corps - E2 to Captain from July 1968 through April 1981.

Financial services is another sector that has initially been immune from job loss, thanks to the power of online technology. “We are lucky that we are in one of those professions that can continue to operate remotely,” says David Evensky, CEO of wealth management firm Evensky &Katz/Foldes. “Our clients are happy about that because many of them are elderly. I think they are appreciative that we can reach them in their living rooms.”

Matt McGrath, managing partner and wealth manager at Evensky & Katz/Foldes Financial, an advisory in Coral Gables, Fla., says what unsettles his most anxious clients is the unprecedented nature of the crisis.

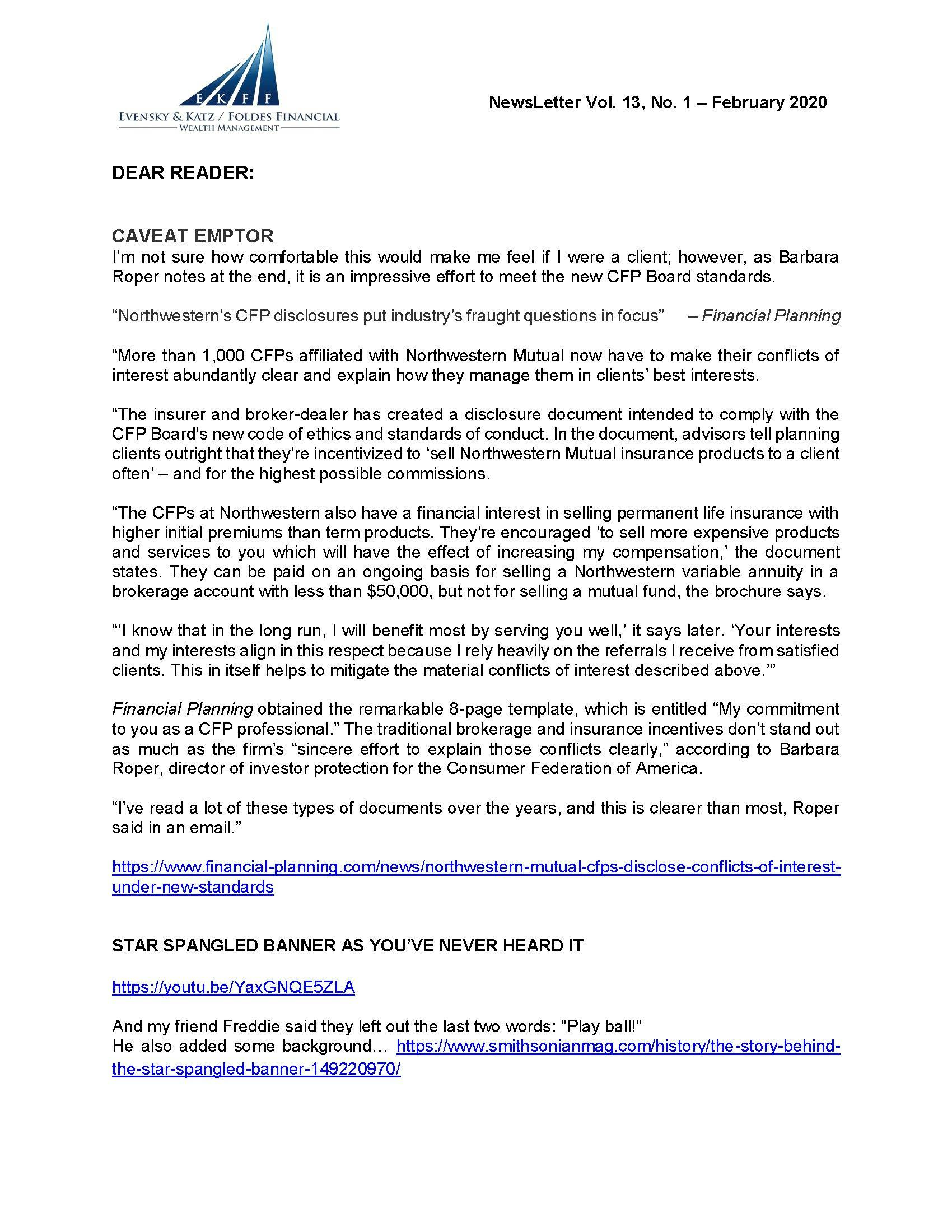

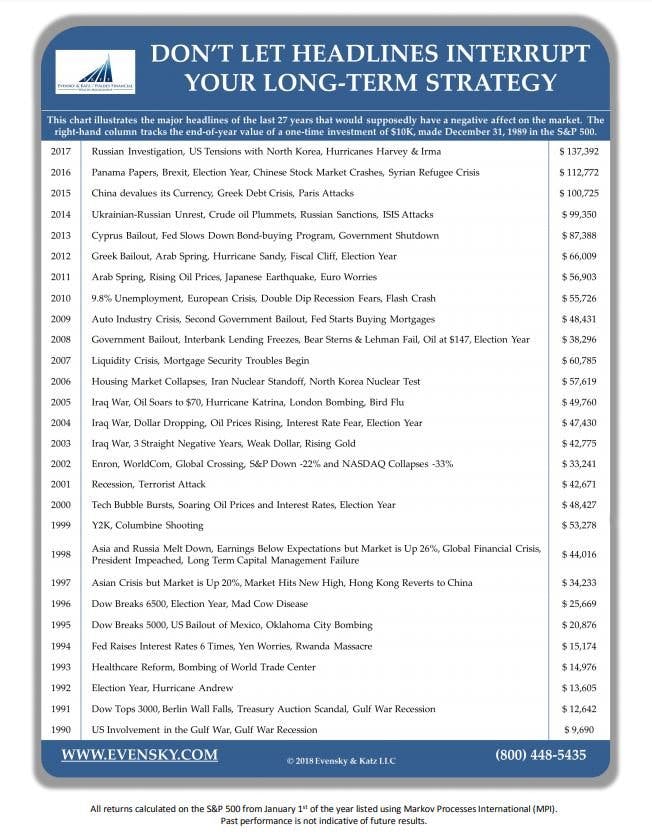

This infographic illustrates the major headlines of the last 27 years that would supposedly have a negative affect on the market.

The industry consensus: Americans aren’t saving enough — if anything — for retirement.

A new survey found 39% of retirees are spending more than anticipated.

When’s the last time you went to the mall to make a purchase?

Finance investors share lessons from the late Vanguard founder.

Not all CFPs may be comfortable with cryptocurrencies.

Books

The Family Information Organizer: Your Planner or any Emergency, Disaster, or Loss of a Loved One

Medicare Made Easy: How to Make the Best Retirement Healthcare Decisions

The Investment Think Tank: Theory, Strategy, and Practice For Advisers

Employee Benefits: How to Make the Most of Your Stock, Insurance, Retirement, and Executive Benefits

Deena Katz's Complete Guide to Practice Management: Tips, Tools, and Templates for the Financial Adviser

Retirement Income Redesigned: Master Plans for Distribution -- An Adviser's Guide for Funding Boomers' Best Years

Wealth Management: The Financial Advisor's Guide to Investing and Managing Client Assets

The New Wealth Management: The Financial Advisor's Guide to Managing and Investing Client Assets

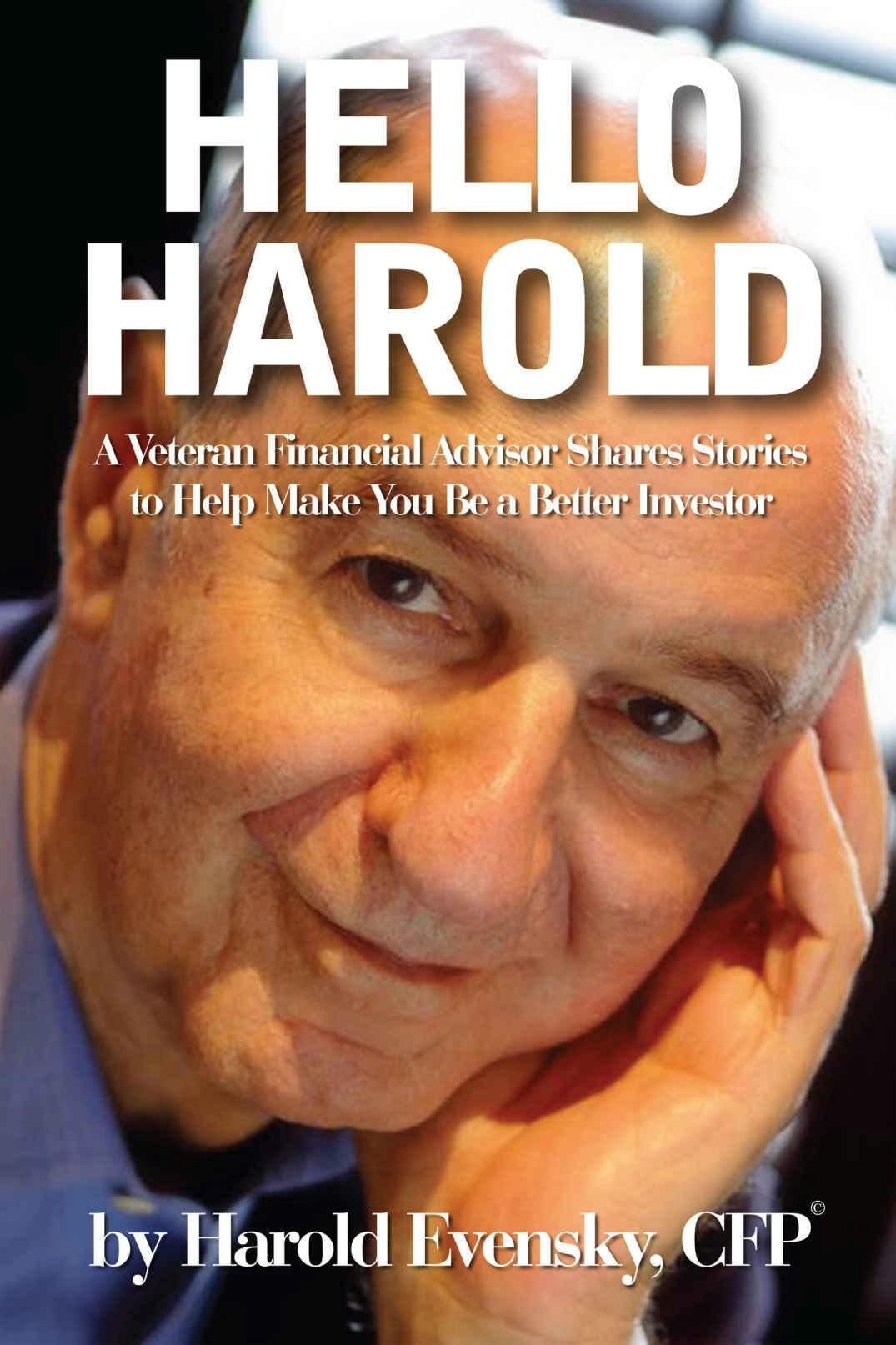

Hello Harold: A Veteran Financial Advisor Shares Stories to Help Make You Be a Better Investor