Smart Starts: The Best Books and Games to Teach Kids About Money (Ages 4–12)

Why Teaching Financial Literacy to Kids Matters

Financial literacy is one of the most important life skills we can teach children—and yet, it’s rarely part of the standard school curriculum. Left unaddressed, money can become a source of confusion or even anxiety later in life. But taught early, it becomes a tool for empowerment. The good news? You don’t have to wait until your child is a teenager to begin these conversations.

Books and games are simple, effective ways to introduce money concepts to kids in a way that feels fun—not like homework. Whether you’re reading at bedtime or playing a board game on the weekend, you’re planting seeds that will grow into lifelong habits.

Why Financial Literacy Should Start Early

Children start forming attitudes about money long before they handle it themselves. The earlier we expose them to basic financial concepts—saving, spending, earning, sharing—the more likely they are to grow up with healthy money habits and decision-making skills.

Introducing money lessons through books and games makes those lessons memorable and fun. Play and storytelling open the door to meaningful conversations, especially when tied to real-life experiences like saving up for a toy or earning an allowance.

Long-Term Benefits of Starting Early:

- Stronger foundations in money management: Kids internalize how money works before facing real-world stakes

- Greater responsibility and accountability: Learning the value of a dollar encourages thoughtful decision-making

- Long-term thinking: Lessons like compound interest make a strong case for patience and planning

- Reduced financial anxiety: Familiarity builds confidence, reducing stress around money as they grow

- Increased confidence and independence: Kids empowered with knowledge are more likely to take initiative later in life

Best Books to Teach Kids About Money

For Ages 4–8: Simple Stories, Big Lessons

At this age, children are concrete thinkers who learn best through stories, repetition, and hands-on experiences. The key is to keep things simple, playful, and relevant to their world—like earning money for doing chores or saving for a favorite toy. Read together and pause to ask questions like, “What would you do in this situation?” or “Have you ever saved up for something?”

Books with strong characters, relatable dilemmas, and a touch of humor go a long way in making financial lessons stick.

A Chair for My Mother by Vera B. Williams

A warm, award-winning story about a family saving up to buy a chair after losing everything in a fire. It gently introduces concepts like goal-setting, budgeting, and delayed gratification.

If You Made a Million by David M. Schwartz

Through whimsical illustrations and imaginative scenarios, this book explores how money is earned, saved, and spent. It’s lighthearted and accessible, yet informative.

One Cent, Two Cents, Old Cent, New Cent by Bonnie Worth

This rhyming, Dr. Seuss-style book offers a colorful look at the history of money and the basics of currency.

The Four Money Bears by Mac Gardner

Featuring fun characters like Spender Bear and Saver Bear, this book introduces kids to the four basic uses of money: spend, save, invest, and give.

Bunny Money by Rosemary Wells

A charming story about Max and Ruby budgeting for a birthday gift—with a few money mishaps along the way. It’s an easy introduction to responsible spending.

For Ages 8–12: Real-World Lessons with Humor and Heart

By this stage, kids are developing stronger critical thinking skills. They’re curious, capable of understanding cause and effect, and increasingly motivated by independence. This is the perfect time to introduce more structured financial concepts—like budgeting, investing, and even entrepreneurship—in a way that still feels fun and accessible.

Let them take the lead: ask what they would do with $100, encourage them to set a savings goal, or challenge them to plan a mini budget for something they want. Books with relatable scenarios and real-world tips work especially well.

Finance 101 for Kids by Walter Andal

A straightforward, engaging guide that covers everything from budgeting to credit, using real-world examples and clear explanations.

How to Turn $100 into $1,000,000 by James McKenna & Jeannine Glista

Equal parts entertaining and practical, this book introduces the basics of entrepreneurship, investing, and long-term financial planning.

Investing for Kids by Dylin Redling & Allison Tom

With accessible explanations and playful characters like Mr. Finance and Investing Woman, this book makes concepts such as diversification and compound interest feel approachable.

Rock, Brock, and the Savings Shock by Sheila Bair

A story about twin brothers who learn dramatically different lessons about saving. The book demonstrates how small habits can lead to big outcomes over time.

Best Games That Teach Kids About Money

Games make abstract financial ideas tangible—and fun. Whether it’s earning income, managing money, or making trade-offs, play helps reinforce lessons in a way that sticks. Look for games that match your child’s age and attention span, and be prepared to talk through their decisions as you play together.

A classic game of buying, selling, and managing money. The Junior edition is perfect for younger players, while the classic version offers a more complex challenge.

Players earn money by doing chores and making choices about spending or saving. A simple but effective simulation of real-life money management.

Created by Rich Dad Poor Dad author Robert Kiyosaki, this game teaches investing, passive income, and financial independence through a kid-friendly lens.

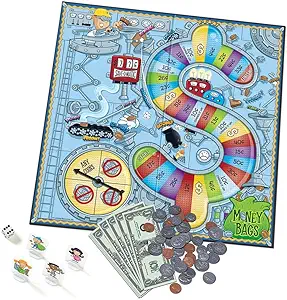

Money Bags – A Coin Value Game

Great for younger children learning to count and manage different types of currency. It introduces coin value recognition and early math skills.

A simple simulation where kids run their own stand, set prices, and manage inventory—learning the basics of business and profit margins.

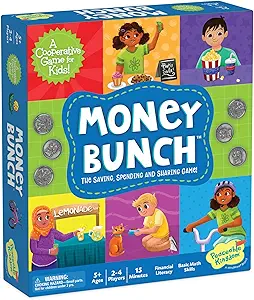

Money Bunch: Save, Spend, Share

A cooperative game where players earn money by doing helpful tasks and deciding how to allocate it across saving, spending, and sharing. It’s especially helpful in teaching generosity alongside financial awareness.

Real-Life Lessons, Real Impact

When it comes to money, I believe in walking the walk. At home, I’ve read Bunny Money with my 5-year-old son, Logan, and we regularly play Monopoly Junior and Money Bunch together. While Money Bunch is designed to be cooperative, Logan’s competitive side wishes it had clear winners and losers—but he still lights up when reaching a savings goal. That joy is proof that financial literacy for kids can be both meaningful and fun.

Whether you’re reading a story about saving for a chair or role-playing a business venture, the takeaway is the same: kids are capable of understanding money. All it takes is a little guidance—and a willingness to make it fun.

Ready to Raise a Money-Savvy Kid?

Start with a story. Play a game. Talk about earning, spending, saving, and giving. The earlier these ideas take root, the more confident your child will feel navigating financial decisions—now and in the future.

Connect with us to to explore how family financial planning can include age-appropriate money lessons and lifelong financial

Categories

Recent Insights

-

Is FIRE Still Realistic?

The modern FIRE movement may be less about quitting work and retiring, and more about buying back your time.

-

Evensky & Katz / Foldes Wealth Management: Interview With Principal & Chief Revenue Officer David Evensky About The Advisory Firm

Evensky & Katz / Foldes Wealth Management is a registered investment advisory firm that provides comprehensive wealth management, financial planning, and investment advisory services to individuals, families, and institutions. Pulse 2.0 interviewed Evensky & Katz / Foldes Wealth Management Principal and Chief Revenue Officer David Evensky to gain a deeper understanding of the company.

-

Budgeting and Financial Organization: Lessons from Life, Love, and Messy Homes

Recently, my wife sent me an opinion article from The New York Times titled “My Home is Messy, and I Don’t Feel Bad About It” by KC Davis. The author highlights many reasons why being messy can be a positive trait—from fostering creativity to accepting that the same DNA that “makes us shine can’t be…

-

Talk Your Chart | 2026 Predictions: A Year in Review and a Look at the Year Ahead | Ep. 75

Episode 75 of Talk Your Chart kicks off the new year with Marcos and Brett revisiting their 2025 predictions to see what held up, what missed, and why. From stocks and bonds to GDP growth and Bitcoin, they break down the charts that mattered most and share their outlook for the year ahead. Charts available…

-

Private Family Foundations: A Legacy of Giving and a Classroom for the Next Generation

For families who want to make a lasting impact, a Private Family Foundation (PFF) can be both a philanthropic vehicle and a platform for teaching values across generations. At its core, a private foundation is a tax-exempt nonprofit organization that you create and control—one that supports the causes you care deeply about, both during your…