Ways to Talk Yourself off the Ledge When the Entire Market Seems Like it’s Falling to Pieces

Nobody likes to see their investments decline, especially during retirement when going back to work may not be an option. The first step is not to panic. Staying calm and rational can help you make better decisions. Market volatility is normal, and remember, markets can shift quickly in the other direction. In fact, 70% of the best days occur within two weeks of the worst days. As the saying goes, it’s about “time in the market,” not “timing the market.”

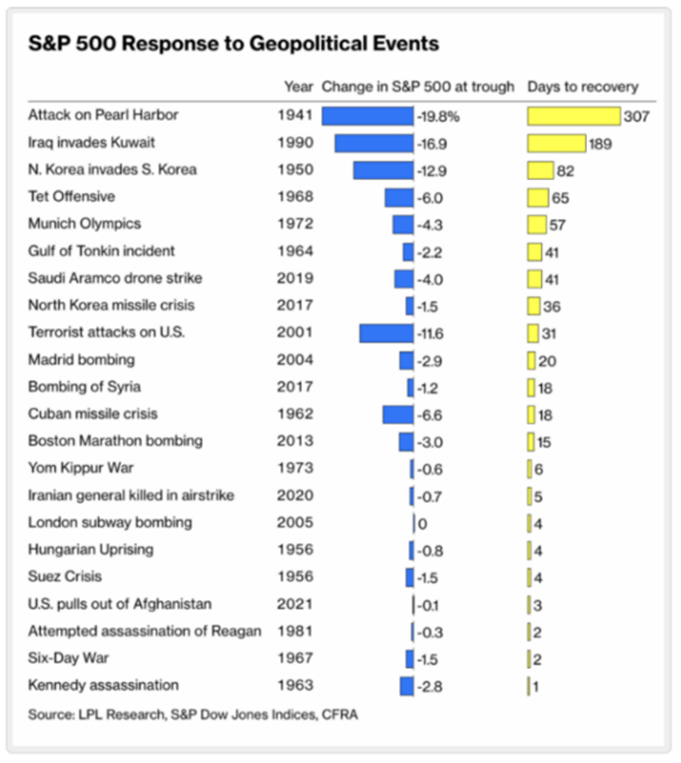

Ongoing economic uncertainty—driven by Fed policy, inflation, and geopolitical tensions—continues to create market volatility. This volatility may get worse before it improves, but there are several strategies you can use during a market downturn that could benefit you in the long term. The key is to focus on what you can control.

What Are Your Alternatives?

Before making any drastic decisions, it’s essential to evaluate your options. Cash yields have improved with higher interest rates, but inflation can still erode purchasing power over time. Other investments such as real estate may provide growth over the long term but can be illiquid. If you’re thinking about pulling out, ask yourself: When will you get back in? Remember, you’re investing for the long haul. You can’t plan for an Armageddon scenario.

Below is a graph showing the performance of the S&P 500 since 2015. This illustrates the power of long-term investing. The market’s sharp rebound after March 2020 shows just how quickly conditions can improve. It’s always four steps forward and one step back—after several years of double-digit returns, pullbacks are inevitable. But if you tried to time the market and got out at the wrong time, you might have missed the recovery, making it much harder to regain lost ground.

Take Advantage of “Assets on Sale”

If you have extra cash on the sidelines that you don’t need within the next 12 months, now is a great time to buy stocks at lower prices. By purchasing more shares during a downturn, you’ll have more exposure when the market rebounds. This can help you recover faster, as you’ll own more shares on the way up than you did when the market was down.

If additional cash isn’t available but you still want to take advantage of the market dip, consider adjusting your allocation to a higher equity position, as long as it aligns with your risk tolerance.

Use Tax Loss Harvesting to Your Advantage

If you’re holding funds with losses but have an alternative that’s similar, you can swap out the underperforming asset for one that mirrors it. For example, if you hold the Vanguard S&P 500 Index and you’re down $20K, you could sell it, take the loss, and buy a similar fund, like the Schwab S&P 500 Index. This strategy allows you to bank the tax loss while still maintaining similar exposure to the market. The loss can offset future taxable gains and reduce your tax burden.

Keep Cash Reserves for Short-Term Needs

It’s important to have 12 months of “grocery money” set aside to cover immediate expenses. This buffer will help you avoid having to sell investments when the market is down, reducing stress. Having cash reserves allows you to be strategic about when and how to replenish them. If you’re feeling anxious about market volatility, you can either withdraw extra cash as a cushion or shift your allocation to more conservative investments. However, this approach should be discussed with your advisor to ensure it matches your risk tolerance.

Review Your Financial Plan and Assumptions

Reviewing your financial plan with your advisor can provide reassurance. Market losses have already been incorporated into your plan, and you can adjust key assumptions like inflation, spending, and returns to see how they affect your long-term outcomes. At Evensky & Katz / Foldes, we already model bad timing scenarios into our plans. These stress tests simulate two consecutive years of poor returns based on your portfolio’s allocation. Keep in mind that your portfolio likely won’t mirror the broad equity market unless you are fully invested in stocks. Bad timing often shows a larger hit when you start drawing down assets for retirement. Fortunately, we also plan for longer-than-average life expectancies, which helps provide some cushion.

Temporarily Reduce Discretionary Spending

If you’re still feeling uneasy, you can temporarily cut back on large purchases like a new car, vacation, or home renovations. We can also model the effects of reduced spending for a few years until the market recovers. Small changes in spending can make a significant difference during downturns, and psychologically, it often feels right to reduce discretionary spending when the outlook is uncertain. Once the market rebounds, you can revisit those purchases.

Trust in Long-Term Growth

At Evensky & Katz / Foldes, we’ve been working with clients for nearly 40 years, and we’ve planned for market volatility. While we can’t predict exactly when volatility will end or what the future holds, faith in capitalism and the global economy’s long-term growth has served us and our clients well. Remember, this too shall pass.

Connect with us to discuss your financial strategy and ensure your portfolio is prepared for whatever the market brings.

Categories

Recent Insights

-

When Love Ends, Who Keeps the Picasso? Dividing Art and Collectibles in Divorce

Divorce is never only about dividing assets. For many couples, the most difficult conversations don’t revolve around bank accounts or real estate—they center on the art, antiques, wine, or collectibles that hold both financial and emotional weight. Over the years, I’ve seen how these items often represent more than monetary value. They are memories, passions,…

-

Talk Your Chart | Market Reversals, AI Interdependence, and What Investors Should Know | Ep. 74

In episode 74 of Talk Your Chart, Brett Horowitz is joined by Lane Jones, Chief Investment Officer at Evensky & Katz / Foldes, to examine some of the most surprising market behaviors of 2025. They break down this year’s historic intraday reversals, why strong economic data can still trigger weak market reactions, and how rate-cut…

-

Combining Donor-Advised Funds and Private Family Foundations for Charitable Giving

When families embark on a philanthropic journey, they often consider whether to create a private family foundation (PFF) or establish a donor-advised fund (DAF). Both vehicles are powerful tools, each with distinct advantages. In practice, many families find that using both together can provide the flexibility, simplicity, and impact they seek. With careful planning, the…

-

Here’s How To Take Your Wine Investment Portfolio to the Next Level

Many investors exploring the world of wine as an asset start with a handful of bottles or a platform account. However, the real challenge (and opportunity) lies in taking a portfolio from “starter” to strategically optimized.

-

The OBBA §179 Deduction: Conversations Every Business Owner Should Be Having

It’s all the buzz… Congress passed another “new law” — the One Big Beautiful Bill Act (OBBBA). In it, major changes to the OBBA §179 deduction start in 2025. For small and mid-sized businesses, this could result in significant tax savings and better cash flow when investing in equipment, technology, or improvements. Forget all the…