Why do experts call my 401k a “qualified plan”?

The quick answer is: A qualified plan is an employer-sponsored retirement plan that qualifies for special tax treatment under Section 401(a) of the Internal Revenue Code.

Now for some not too detailed details…

There are many different types of qualified plans, but they all fall into two categories. (1) Defined benefit plans (like a traditional pension plan) are generally funded solely by employer contributions and provide you with a specified level of retirement benefits. That specific level of benefit is why it is called a defined benefit plan. (2) Defined contribution plans (like a profit-sharing or 401(k) plan) are funded by employer and/or employee contributions. For these types of plans, only the contributions are defined as you don’t know exactly what the benefit will be in the future. The benefits you receive from the plan depend on investment performance and your and your employer’s contribution.

The annual contribution limits and other rules vary among specific types of defined benefit and defined contribution plans. However, most qualified plans share certain key features:

- Pretax contributions: Employer contributions to a qualified plan are generally able to be made on a pretax basis. That is, you don’t pay income tax on amounts contributed by your employer until you withdraw money from the plan. Your contributions to a 401(k) plan may also be made on a pretax basis.

- Roth contributions: Your employer may also allow you to make after-tax Roth contributions to the 401(k) plan. While there’s no up-front tax benefit, qualified distributions are totally free from federal income taxes.

- Tax-deferred growth: Investment earnings (dividends, interest, capital gains) on all contributions are tax-deferred. Again, you don’t pay income tax on those earnings until you withdraw money from the plan.

- Vesting: If the plan provides for employer contributions, those amounts (and associated investment earnings) must vest before you’re entitled to them. For example, a five-year graded vesting schedule could give 20 percent ownership after the first year, then 20 percent more each year until employees gain full ownership after five years. If the employee leaves before five years have passed, he or she only gets to keep the percentage that has been vested. One reason employers do this is to help retention.

- Creditor protection: A creditor is a person or company that you owe money to. In most cases, your creditors cannot reach your qualified retirement plan funds to satisfy your debts.

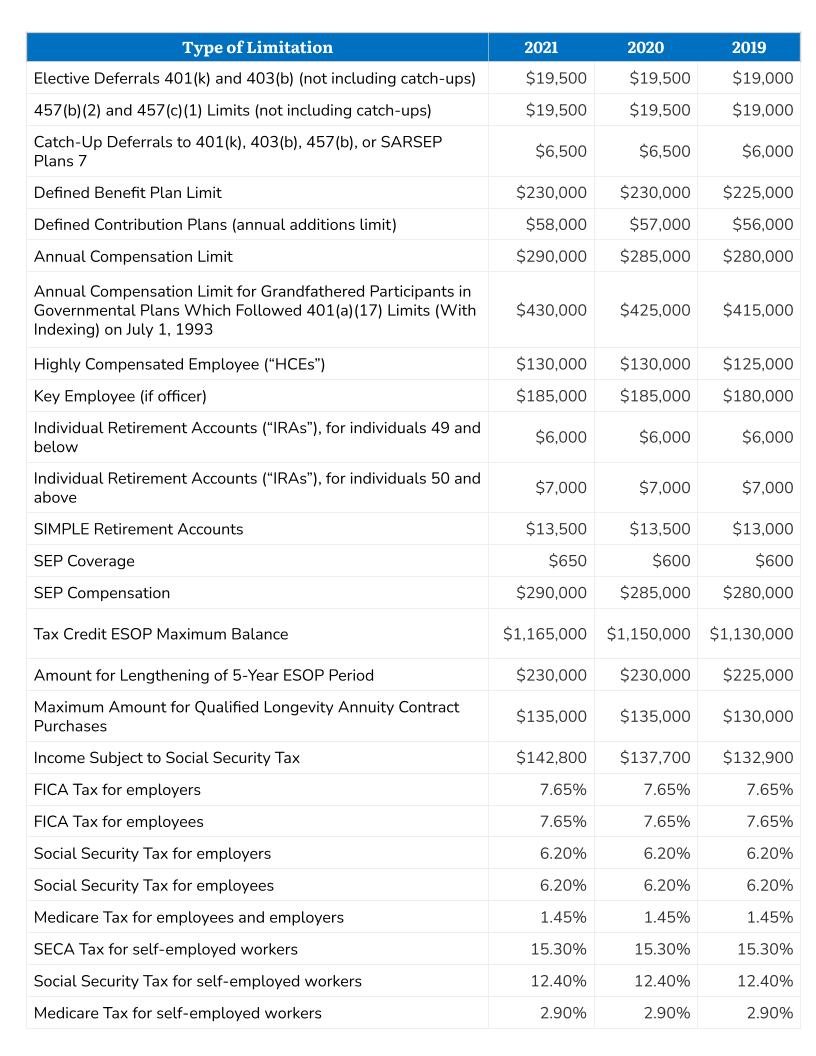

Lastly, I mentioned differences in annual contributions. Below is a breakdown of the different limits. Important to note that since traditional IRAs and Roth IRAs are not sponsored by an employer, they are technically not qualified plans. I’ve included past years for comparison purposes. Some of the “types of limits” may not be intuitive based on the name. That’s a good opportunity to reach out to us and find out what each means!

Happy Investing!

Marcos

Categories

Recent Insights

-

The Looming ACA Premium Tax Credit Cliff: How Families Can Manage Rising Healthcare Costs

Picture this: You finally have a handle on your healthcare costs. The numbers make sense. The plan fits. But a sudden change in policy could flip everything upside down. It can feel like the ground shifting beneath your feet. For many families, the potential expiration of enhanced ACA Premium Tax Credits at the end of…

-

Charitable Planning During a Liquidity Event: What to Consider Before You Sell

Liquidity events—selling a business, real estate, or a concentrated stock position—are rare moments that often define a business owner’s financial and philanthropic legacy. Before you sign the papers, thoughtful charitable planning can transform a tax liability into a purposeful legacy. The central rule is simple: start before the deal closes. Why timing matters When a…

-

When Love Ends, Who Keeps the Picasso? Dividing Art and Collectibles in Divorce

Divorce is never only about dividing assets. For many couples, the most difficult conversations don’t revolve around bank accounts or real estate—they center on the art, antiques, wine, or collectibles that hold both financial and emotional weight. Over the years, I’ve seen how these items often represent more than monetary value. They are memories, passions,…

-

Talk Your Chart | Market Reversals, AI Interdependence, and What Investors Should Know | Ep. 74

In episode 74 of Talk Your Chart, Brett Horowitz is joined by Lane Jones, Chief Investment Officer at Evensky & Katz / Foldes, to examine some of the most surprising market behaviors of 2025. They break down this year’s historic intraday reversals, why strong economic data can still trigger weak market reactions, and how rate-cut…

-

Combining Donor-Advised Funds and Private Family Foundations for Charitable Giving

When families embark on a philanthropic journey, they often consider whether to create a private family foundation (PFF) or establish a donor-advised fund (DAF). Both vehicles are powerful tools, each with distinct advantages. In practice, many families find that using both together can provide the flexibility, simplicity, and impact they seek. With careful planning, the…